5 Reasons You Should Buy Shopify and Hold for the Long Term

Multi-channel e-commerce platform Shopify Inc. (NYSE: SHOP) has been a stock market darling since the company debuted in early 2015. In three short years, the company has increased its revenue by nearly five times and more than tripled the number of merchants that use its service.

Shopify's 2017 fourth quarter was representative of its recent performance, reporting revenue of $222.8 million, up 71% year over year. This marked the 11th consecutive quarter that sales exceeded 70% year-over-year growth. The company produced adjusted earnings per share of $0.15, compared to no profit in the prior year quarter.

The stock price has followed the financial results, soaring 365% since going public. Investors are rightly wondering if it's too late to buy Shopify. The company is riding a massive trend and still has an incredible opportunity, and I don't believe its run is over. Here are five reasons I think Shopify is still a great investment.

There are lots of reasons for investors to love Shopify. Image source: Shopify.

1. It's riding the wave of e-commerce

Despite the proliferation of e-commerce, this trend is still in its early stages and will continue to see rapid adoption. For the fourth quarter of 2017, U.S. online sales represented 8.9% of total retail, up from about 3.5% just a decade earlier. Confidence in purchases made over the internet, the ease of online ordering, and the deep penetration of broadband have all accelerated the acceptance of e-retail.

That trend is expected to continue. E-commerce grew to $2.3 trillion worldwide in 2017, and that figure is expected to more than double to $4.88 trillion by 2021.

2. It survived significant competition

In the realm of e-commerce, there's no bigger competition than Amazon.com, Inc. (NASDAQ: AMZN). In its early days, Shopify's platform, which makes it easy for small- and medium-sized businesses to set up and run an online store, competed directly with the tech behemoth. Amazon's Webstore platform provided the same service as Shopify. Amazon eventually ceded the business, shuttering its own platform. It even made Shopify a preferred provider and ported its existing customers over to its smaller rival. Shopify still supports merchants doing business on Amazon's e-commerce site.

3. Its relentless focus on growth

In nearly three years as a public company, Shopify hasn't once produced a profit under generally accepted accounting principles (GAAP). The biggest reason for this is that the company has plowed all its potential profits back into expanding its business. The company has been driving this growth in a number of ways.

Shopify is channel-agnostic, courting sellers from across the spectrum on platforms like Amazon and eBay, as wells as more social sites like Facebook and Pinterest -- and is regularly increasing the number of new channels -- most recently adding Instagram.

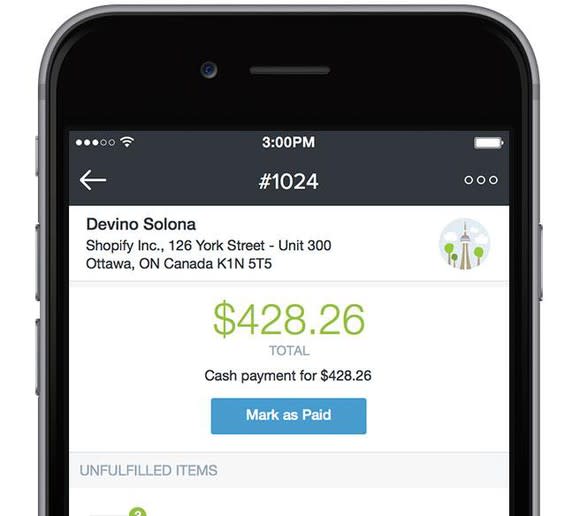

Ease of use is also a significant draw. Shopify supplies more than 100 ready-to-use templates and 2,300 apps to help merchants design and customize a website. The company also acts as a one-stop-shop where merchants can manage inventory, process invoices and payments, and ship and track orders. It also provides users with cutting-edge analytics and reports to help keep their businesses moving forward.

Shopify is changing the game for online sellers. Image source: Shopify.

4. Its international opportunity

Shopify has continued the blistering pace of its worldwide expansion, serving users in 175 countries, though international merchants currently make up just 19% of the total. The company has been taking the features that made it so successful in its U.S. market and making them available in international markets. Shopify is working to translate its blogs into other languages, which has been key to attracting new merchants in foreign locales. The company is also expanding its Shopify Pay option internationally. This gives merchants and their customers the option of capturing and saving payment data, and simplifying the checkout process for future transactions.

5. It's expanding upmarket

As the story goes, Shopify began when founder Tobias Lutke and his friend Scott Lake couldn't find a simple e-commerce platform to sell a line of elite snowboards to customers online. Thus began the company's journey to help pave the way for other smaller online merchants.

In early 2014, Shopify began to expand its offerings to serve larger merchants with high-volume operations. When some of the company's earlier customers began to outgrow their platform, Shopify realized it could scale its business to accommodate larger customers. The results of those efforts were Shopify Plus, a platform that now hosts 3,600 enterprise level, big-name companies like Ford and Live Nation. It also generates 21% of the company's monthly recurring revenue, up from 17% in the prior year quarter.

It may not be a straight line

By focusing on reducing the friction points and helping make its merchants successful, Shopify is providing a long runway for its own future growth. While the company has made all the right moves to ensure its success, there are no guarantees. The company has been a target of noted short-seller Citron Research, who has attacked the company twice since October, causing the shares to decline in the process. This helps to illustrate that while I believe that the company will be a long-term winner, its shares will likely be volatile at times.

All things considered, I remain an enthusiastic shareholder in the young, but fast-growing company.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Danny Vena owns shares of Amazon, Facebook, and Shopify and has the following options: long January 2019 $18 calls on eBay and short April 2018 $35 calls on eBay. The Motley Fool owns shares of and recommends Amazon, eBay, Facebook, and Shopify. The Motley Fool recommends Ford and Live Nation Entertainment. The Motley Fool has a disclosure policy.