America gets its own replacement to Libor: Ameribor

The world will need a new benchmark for interest rates once Libor is no longer published at some point in 2021, and Richard Sandor hopes his latest invention, Ameribor, will be the leading alternative.

In 2015, Sandor created the American Financial Exchange, which allows banks and financial institutions to lend and borrow from one another at interest rates benchmarked by its own index, Ameribor.

AFX expects to launch futures on the Ameribor benchmark on the Cboe Futures Exchange on August 16.

Sandor saw the opportunity to build a new American-based benchmark as the London Inter-bank Offered Rate faced a wave of multiple scandals involving rate rigging by major banks.

“It was amazing to me in 2011 that America, the world’s largest economy did not have its own benchmark,” Sandor told Yahoo Finance. “How could it be that a $20 trillion economy was having rates set in London by 18 banks calling each other?”

Making the transition

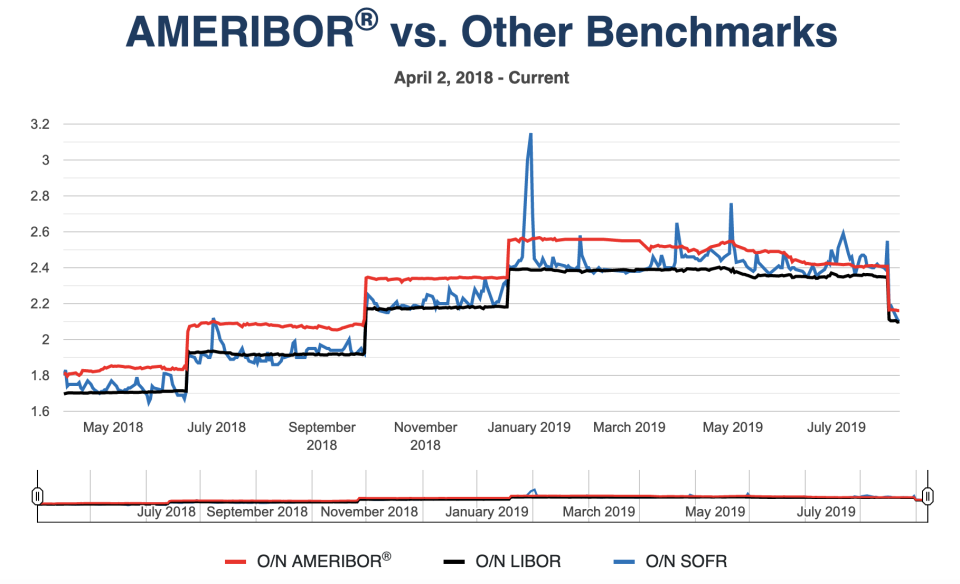

Ameribor is a market-driven benchmark interest rate that contains a credit spread component. That differentiates Ameribor from the Federal Reserve’s separate benchmark, called the Secured Overnight Financing Rate. Like Ameribor, SOFR is calculated based on market transactions, specifically in the repurchase agreement (repo) markets. But unlike Ameribor, SOFR is “secured” and collateralized by Treasury securities.

While SOFR has been adopted among the large banks — like Bank of America, Citigroup, and JPMorgan Chase — that helped the Fed create it, Ameribor is being marketed to smaller banks that do not borrow at either Libor or SOFR.

Ameribor has more than 100 members, many of which are regional and mid-size community banks. Its membership also includes private equity firms, broker-dealers, and insurance companies. Sandor says Ameribor’s unsecured structure is attractive to its members because it helps index yield on borrowing and lending that reflects more vanilla banking activities like underwriting auto loans and corporate loans. His goal: to make Ameribor the leading benchmark when Libor goes offline.

“I hate to lose, it’s just not a good feeling,” Sandor said.

Broadly, regulators have pushed on firms around the world to move faster on transitioning away from Libor. Although 2021 is some time away, regulators like the Fed’s Randal Quarles have expressed worry that markets could face liquidity pressures as it is phased out.

“My key message to you today is that you should take the warnings seriously,” Quarles told market participants in a speech in June.

And the Securities and Exchange Commission has warned that there could be “business and market disruptions” partially as a result of Libor-indexed contracts that extend past 2021 without consideration to the discontinuation of Libor.

Sandor says he is doing his part to educate the financial world about alternative rates like Ameribor. He says he has been on a roadshow talking to accountants, lawyers, and even MBA students about the issue.

“Markets have to be built, Sandor said. “They’re not like spontaneous combustion.”

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

The grey area between currency devaluation and currency manipulation

Boston Fed President: No 'clear and compelling' case for this week's rate cut

Fed faces questions on ‘data-dependence’ heading into possible rate cut

Congress may have accidentally freed nearly all banks from the Volcker Rule

Read the latest financial and business news from Yahoo Finance