Analysts Have Lowered Expectations For GOME Retail Holdings Limited (HKG:493) After Its Latest Results

GOME Retail Holdings Limited (HKG:493) missed earnings with its latest full-year results, disappointing overly-optimistic forecasters. It was a pretty negative result overall, with revenues of CN¥59b missing analyst predictions by 7.5%. Worse, the business reported a statutory loss of CN¥0.13 per share, much larger than the analysts had forecast prior to the result. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for GOME Retail Holdings

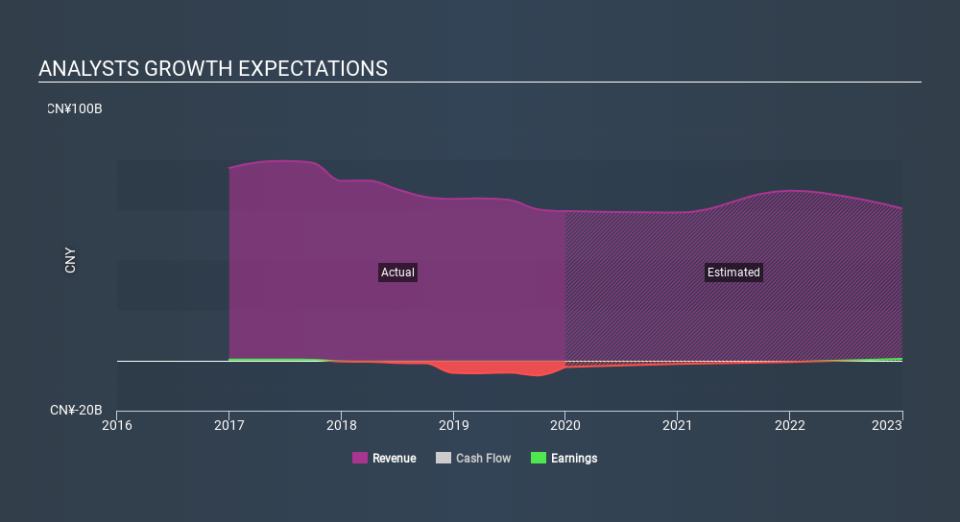

Taking into account the latest results, GOME Retail Holdings' five analysts currently expect revenues in 2020 to be CN¥58.9b, approximately in line with the last 12 months. Losses are predicted to fall substantially, shrinking 54% to CN¥0.06. Yet prior to the latest earnings, the analysts had been forecasting revenues of CN¥67.5b and losses of CN¥0.022 per share in 2020. So there's been quite a change-up of views after the recent consensus updates, withthe analysts making a serious cut to their revenue outlook while also expecting losses per share to increase.

The average price target was broadly unchanged at CN¥0.48, perhaps implicitly signalling that the weaker earnings outlook is not expected to have a long-term impact on the valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on GOME Retail Holdings, with the most bullish analyst valuing it at CN¥0.62 and the most bearish at CN¥0.36 per share. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Of course, another way to look at these forecasts is to place them into context against the industry itself. Over the past five years, revenues have declined around 0.1% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for a 0.9% decline in revenue next year. Compare this against analyst estimates for companies in the wider industry, which suggest that revenues (in aggregate) are expected to grow 11% next year. So it's pretty clear that, while it does have declining revenues, the analysts also expect GOME Retail Holdings to suffer worse than the wider industry.

The Bottom Line

The most important thing to note is the forecast of increased losses next year, suggesting all may not be well at GOME Retail Holdings. Unfortunately, they also downgraded their revenue estimates, and our data indicates revenues are expected to perform worse than the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for GOME Retail Holdings going out to 2022, and you can see them free on our platform here..

We don't want to rain on the parade too much, but we did also find 1 warning sign for GOME Retail Holdings that you need to be mindful of.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.