Better Gold Streaming Stock to Buy: Royal Gold vs. Franco-Nevada Corp

With very few exceptions, gold stocks have tended to lag behind the returns of the S&P 500 in most historical periods. That's because mining is simple, but not easy. Companies have to process thousands of tons of earth to get a few thousand ounces of the precious metal. It's expensive -- and there isn't much room for error.

That explains why most of the gold stocks that have managed to beat the index over the years aren't involved in mining at all. Rather, they're gold streaming companies, which purchase a certain portion of production from miners at fixed prices, then turn around and sell it for big profits. It's a low overhead and inherently high-margin business model.

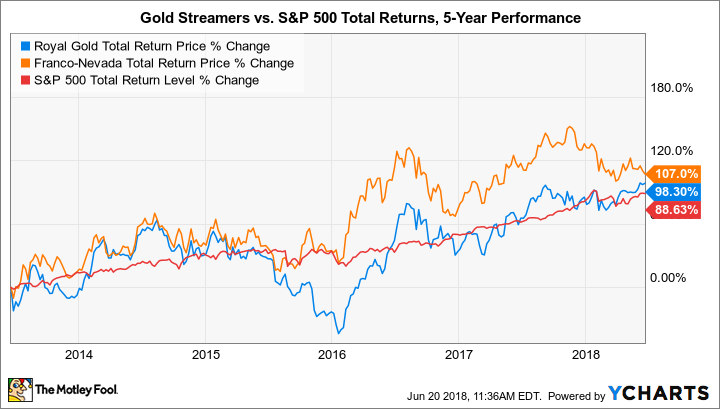

It's also treated Royal Gold (NASDAQ: RGLD) and Franco-Nevada Corp (NYSE: FNV) shareholders pretty well, with total returns of 98% and 107%, respectively, in the last five years, compared to 88% for the S&P 500. They've been pretty evenly matched recently, but is one gold streaming stock a better buy going forward?

Image source: Getty Images.

The matchup

Royal Gold stock has been cruising in 2018, posting year-to-date gains of 13%. The increase in share price has certainly been earned. Through the first nine months (ended March 2018) of the gold streamer's fiscal 2018, operating cash flow has jumped 25% compared to the year-ago period. And that's despite revenue growth of only 3% in the same comparison periods.

That also means Royal Gold converted 73% of revenue into operating cash flow in the first three quarters of its fiscal 2018. However, investors might want to note that number could be slightly inflated: The business converted 90% of revenue into operating cash flow in the most recent quarter thanks largely to some changes in working capital that gave its cash balance a boost.

Either way, in the first nine months of fiscal 2017, the business converted 59% of revenue into operating cash flow -- still an unbelievable number. That has allowed Royal Gold to pile up cash on its balance sheet while reducing debt 28% and increasing dividends paid 4% from June 2017 to March 2018. The progress should continue.

Several streaming and royalty agreements are about to activate as new mines and expansion projects come online, which will boost gold equivalent ounces purchased and sold in future periods. The timing couldn't be better. While Royal Gold reported volume of 87,300 gold equivalent ounces in the fiscal third quarter of 2018 -- roughly equivalent to the year-ago period -- gold prices were 9% higher in the most recent three-month frame. That played a big role in boosting revenue 8% and increasing cash flow, too, even after accounting for the one-time adjustments. Simply put, this gold streaming company is poised for its next phase of growth.

RGLD Total Return Price data by YCharts.

Franco-Nevada is no slouch, either. In fact, it's fresh off record first-quarter results reported in 2018. The streaming business delivered revenue of $173 million and net income of $64.6 million -- both records -- and $137 million in operating cash flow. That means it converted 79% of revenue into cash flow. No accounting adjustments required.

Despite the solid performance from operations, the gold streaming stock has lost 13% of its value in 2018. What's up with that? Well, the company reported that its gold equivalent ounces production fell 12% in the first quarter of 2018 compared to the year-ago period.

Management has actually told investors to expect lower output this year, but investors aren't happy with the timing. After all, gold prices are strong, so every ounce of lost production is an ounce of lost earnings potential. Additionally, Franco-Nevada was trading at a hefty premium to its peers, so Mr. Market is taking the opportunity to readjust the company's market valuation lower.

Of course, this is not a business struggling to turn a profit. If management executes on the long-term strategy, then growth might not be difficult to come by, either. Franco-Nevada thinks it can grow gold equivalent ounces 17% from 2017 to 2022. Meanwhile, the company has copied its business model for precious metals to the oil and gas industry, entering into royalty agreements with energy production assets, too. The company believes it will grow oil and gas revenue 81% from 2017 to 2022. The combined growth paints a pretty rosy picture of the company's future.

Image source: Getty Images.

By the numbers

Both Royal Gold and Franco-Nevada appear to be on a promising long-term trajectory thanks to a healthy portfolio of streaming and royalty agreements put in place years ago. As more and more mines come online in the next several years, both businesses will enjoy higher levels of precious metals sales. And if gold prices remain elevated -- or continue to trek higher -- then both companies could see their cash flow soar.

Knowing that, are there any clear differences between the two gold stocks today that would make one the better buy? Here are several selected financial metrics.

Metric | Royal Gold | Franco-Nevada Corp |

|---|---|---|

Market cap | $6.0 billion | $13.1 billion |

Dividend yield | 1.1% | 1.4% |

Forward P/E | 42.4 | 60.0 |

EV to EBITDA | 19.9 | 24.7 |

Gold equivalent ounces sold, most recent quarter | 87,300 | 115,671 |

Year-to-date total return | 12.9% | (13.3%) |

Data source: Yahoo! Finance.

The table above illustrates why Wall Street hasn't had a problem adjusting Franco-Nevada's market cap lower this year. Even with a 13% slide in share price, the company trades at a significant premium to its smaller peer, Royal Gold. While the larger gold streamer pays a higher dividend and has no debt on its balance sheet, that may not make up for a relatively pricey stock.

Image source: Getty Images.

The better buy is...

I think both gold streaming stocks are poised to continue beating the S&P 500 in the long term. However, if investors had to choose just one right now, Royal Gold would get the nod. The company's lower valuation could allow shareholders to capture more of the benefit from future growth, whereas Wall Street might want Franco-Nevada to grow into its premium valuation before handing it a higher stock price.

That said, having no debt on the balance sheet and owning diverse business interests in energy production could provide an edge to the larger streamer in the future. Interest rates are on the rise around the globe, and energy prices are booming, but it's still difficult to see either making a significant difference anytime soon. That's why the smaller peer is a better buy right now.

More From The Motley Fool

Maxx Chatsko has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.