Blue Apron is cooking up a turnaround

It seems everyone is getting into the meal-kit business these days. Grocers Albertsons, Kroger (KR), Walmart (WMT), even Amazon (AMZN) are selling pre-packaged meals to busy Americans. That means a lot more competition for meal-kit pioneer Blue Apron (APRN).

The subscription-based online meal-kit delivery service recently debuted its first pop-up store in New York City, which is open through June 24.

It’s the latest step in the New York–based company’s ongoing turnaround plan under CEO Brad Dickerson, who took over the reins in November 2017, after having served as Blue Apron’s chief financial officer.

“Being a direct-to-consumer business, we have a lot of interactions with our companies, a lot of data on our customers, but not a lot of physical interaction,” Dickerson tells me in the video above. “The pop-up store is a great way for us to have people learn more about our brand.”

For instance, Dickerson says some people may not realize that Blue Apron has a wine business, or that it recently launched its Dinner Party Box meal kits.

The pop-up store features cooking classes and panel talks from notable chefs including Tamar Adler, Marco Canora, and Sam Kass, as well as a selection of Blue Apron products available for purchase.

“We also have mobile experiences planned in other parts of the country to engage customers in other geographic regions,” Dickerson explains.

Similar two-day pop-ups are scheduled for cities including Los Angeles, San Francisco, Minneapolis, and Seattle. Depending on the success of its pop-up stores, Dickerson says his team will evaluate whether Blue Apron opens select permanent brick-and-mortar locations.

The Costco play

In another bid to expand its reach, Blue Apron has started selling its meal kits in Costco as part of a pilot program at locations in the Pacific Northwest and San Francisco Bay areas.

“We want to have more of an on-demand product that can be sold at a retail location,” says Dickerson. “That customer may make decisions on the same day on what meals they want, and we should be able to meet them on their terms.”

If the pilot program is a success, Dickerson says Blue Apron may expand its meal kits into more Costco stores, and they’re also speaking with other retailers about selling the kits, though Dickerson declined to say which ones.

Some industry watchers believe Costco could be interested in acquiring Blue Apron. It’s become a familiar story. Albertsons bought meal kit company Plated, and Kroger bought Home Chef in order to capitalize on the meal-kit craze.

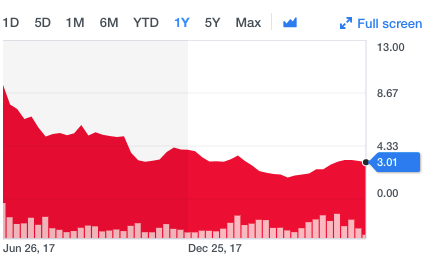

Blue Apron’s stock blues

Blue Apron has struggled since going public in June, 2017. This one-time unicorn, valued at nearly 3 billion dollars by private investors, is now worth about $610 million. The stock has tumbled roughly 70 percent from its IPO price of $10 per share. Its latest earnings report shows a revenue decline of 20% year-year-over as it shed 250,000 subscribers last year alone, leaving it with about 786,000 members.

“We had some operational challenges at the back end of last year that made us focus on operations,” Dickerson says. “The good news is that our operational efficiencies have improved tremendously and we’re taking advantage of that by spending more money on marketing and acquiring more customers.”

Dickerson still believes Blue Apron is on track to break even in the fourth quarter and for all of 2019.

“We have a lot of focus on that goal. Our three fulfillment centers have become a lot more efficient over the last few quarters. It’s not about cost-cutting; it’s about focusing on efficiencies.”

Alexis Christoforous is the anchor of Market Movers on Yahoo Finance. Follow her on Twitter and Instagram @AlexisTVNews.