How is Capri Holdings (CPRI) Placed Ahead of Q4 Earnings?

Capri Holdings Limited CPRI is likely to see a year-over-year decline in the top line when it reports fourth-quarter fiscal 2020. The designer and marketer of branded apparel and accessories has a trailing four-quarter positive earnings surprise of 1.7%, on average.

However, the Zacks Consensus Estimate for fourth-quarter earnings stands at 32 cents, suggesting a decline of 49.2% from the year-ago quarter. We note that the consensus estimate has moved 22% down over the past 30 days. The consensus mark for revenues is pegged at $1.18 billion, indicating a fall of roughly 12% from the year-ago quarter’s tally.

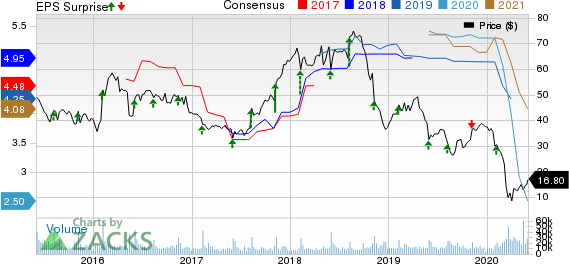

Capri Holdings Limited Price, Consensus and EPS Surprise

Capri Holdings Limited price-consensus-eps-surprise-chart | Capri Holdings Limited Quote

Key Factors to Note

Capri Holdings is not immune to the effects of the coronavirus outbreak. The company has shut stores in North America and Europe as well as furloughed all its North American retail store employees. Loss of sales from closed outlets has most likely marred its fiscal fourth-quarter results. For a while now, revenues have been soft for Michael Kors, which accounts for a major portion of the top line. During its last earnings call, management noted that given the situation in China, it expects fourth-quarter revenues and earnings per share to be hit by approximately $100 million and 40-45 cents a share, respectively.

Nevertheless, Capri Holdings’ commitment toward deploying resources to expand product offerings, building “shop-in-shops,” and upgrading information system and distribution infrastructure is likely to have cushioned performance in the to-be-reported quarter. Notably, the company has been expanding product mix beyond handbags into men’s, footwear and women’s ready to wear. Moreover, the company’s fourth-quarter results are anticipated to reflect gains from inventory management and focus on the e-commerce platform.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Capri Holdings this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Capri Holdings has a Zacks Rank #5 (Strong Sell) and an Earnings ESP of -81.42%.

3 Stocks With a Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Fastenal FAST has an Earnings ESP of +2.37 and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Casey’s CASY has an Earnings ESP of +40.82% and a Zacks Rank #3.

Chico's FAS CHS has an Earnings ESP of +67.74% and a Zacks Rank #3.

5 Stocks to Soar Past the Pandemic: In addition to the companies you learned about above, we invite you to learn about 5 cutting-edge stocks that could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of the decade.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fastenal Company (FAST) : Free Stock Analysis Report

Chicos FAS, Inc. (CHS) : Free Stock Analysis Report

Caseys General Stores, Inc. (CASY) : Free Stock Analysis Report

Capri Holdings Limited (CPRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research