Some New Gold (TSE:NGD) Shareholders Have Taken A Painful 74% Share Price Drop

New Gold Inc. (TSE:NGD) shareholders will doubtless be very grateful to see the share price up 76% in the last quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. To wit, the share price sky-dived 74% in that time. So we're relieved for long term holders to see a bit of uplift. Of course the real question is whether the business can sustain a turnaround.

See our latest analysis for New Gold

Given that New Gold didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, New Gold saw its revenue grow by 3.6% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Nonetheless, it's fair to say the rapidly declining share price (down 36%, compound, over three years) suggests the market is very disappointed with this level of growth. We generally don't try to 'catch the falling knife'. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

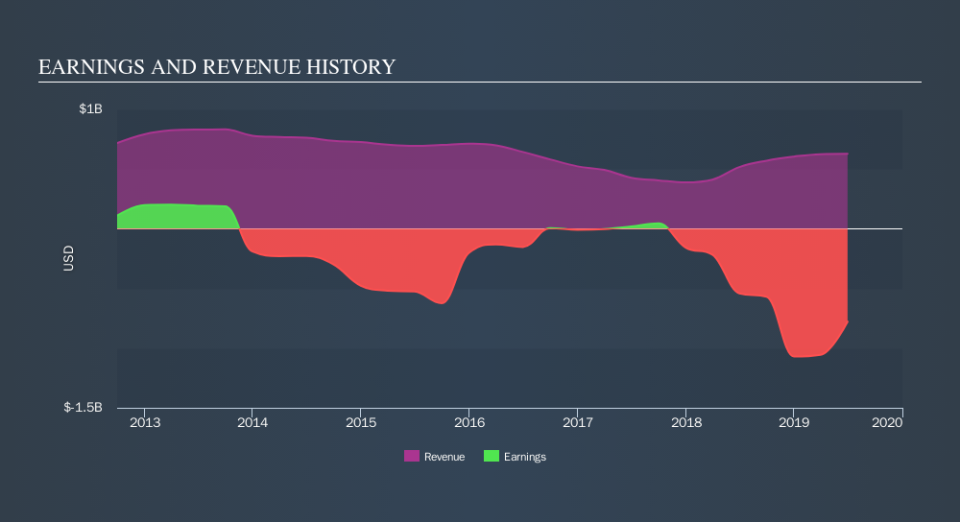

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think New Gold will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that New Gold shareholders have received a total shareholder return of 14% over the last year. That certainly beats the loss of about 23% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of New Gold by clicking this link.

New Gold is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.