Intel Corp. Reveals New Detail About Upcoming 10-Nano Tech

Earlier this year, microprocessor giant Intel (NASDAQ: INTC) hosted its first Technology and Manufacturing Day. At that event, the company talked about its current and future chip manufacturing technologies, as well as the impact that the manufacturing technology strategy would have on the company's product portfolio in the years ahead.

Image source: Intel.

Then, last month, Intel hosted a version of its Technology and Manufacturing Day, but instead of hosting it in the United States, it hosted it in China.

At the China version of the event, Intel presented some interesting new information about its upcoming 10nm technology and, perhaps more interestingly, made clear a key aspect of its 10nm technology that seems to put it in a better light vis-à-vis the company's currently shipping 14nm++ technology.

Better performance per watt

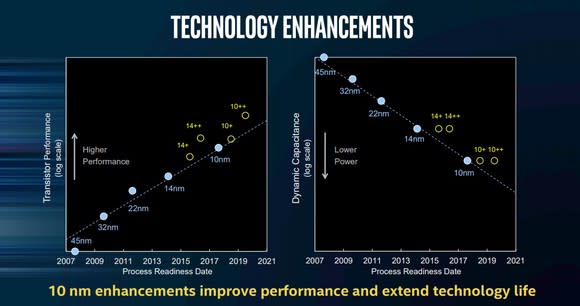

In the March presentation, Intel showed the following slide:

Image source: Intel.

This slide indicates that Intel's third-generation 14nm technology, known as 14nm++, offers higher transistor performance than either Intel's upcoming 10nm technology or even its second-generation 10nm+ technology -- something I called "disappointing" back in March.

The slide also indicates that Intel's 10nm technologies offer lower dynamic capacitance (which Intel says translates into lower power) than its 14nm counterparts.

What Intel showed at its Technology and Manufacturing Day in China was how these two factors -- dynamic capacitance and transistor performance -- translate into performance per watt, which is a measure of manufacturing technology efficiency.

Here's the slide:

Image source: Intel.

The takeaway from this slide is this: Even though Intel's 14nm++ technology seems to be able to deliver slightly higher transistor performance than either the company's 10nm or 10nm+ technologies, it does so by consuming quite a bit more power.

That increased power consumption ultimately means that even Intel's highly refined third-generation 14nm technology is still less power efficient than Intel's upcoming first-generation 10nm technology, let alone the second- and third-generation versions of Intel's 10nm technology.

What does this mean?

The good news is that once Intel can finally bring its 10nm-based chips to market, they should -- by virtue of the manufacturing technology upon which they are built as well as chip design improvements -- be quite a bit more efficient than Intel's current products.

This should help just about every segment of Intel's business, as most computing devices -- from notebook personal computers to cloud servers -- significantly value power efficiency.

Unfortunately, it's still not clear when Intel will be able to bring its 10nm technology to most of its products.

Indeed, while Intel is claiming that it plans to introduce its first 10nm products by the end of this year and will ramp up volume during the first half of next year, it still looks as though the bulk of Intel's revenue next year will come from products manufactured using various derivatives of Intel's 14nm technology.

The reality is that while on paper Intel's claims about both the efficiency and density of its 10nm technology look good, products based on the technology have been delayed time and again.

So, to play it safe, don't expect Intel to bring the goodness of its 10nm to many key areas of its business, from gaming personal computers to data centers, until at least 2019.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

Ashraf Eassa owns shares of Intel. The Motley Fool recommends Intel. The Motley Fool has a disclosure policy.