Looking for Gold Dividends? Think Twice Before Jumping Into Wheaton Precious Metals

If you are an income investor looking at gold stocks you might be tempted to buy Wheaton Precious Metals (NYSE: WPM), a gold and silver streaming company with a relatively high yield. It's not a bad stock to own, but it may not be the best dividend stock for your portfolio if you don't understand a few important basics. Here's what you need to know before you buy Wheaton for its peer-beating dividend yield.

What Wheaton does

The first thing to understand is that Wheaton Precious Metals is not a miner. It is a streaming company. That means it provides cash up front to miners in exchange for the right to buy gold and silver at reduced rates in the future. It's a business model that provides Wheaton with wide margins in both good markets and bad because of its contractually locked-in low prices.

Image source: Getty Images

It's a strong business model that gives Wheaton and its peers, Royal Gold, Inc. (NASDAQ: RGLD) and Franco-Nevada Corporation (NYSE: FNV), a leg up on miners, which have to deal with the costs and variability of running mines. However, streaming doesn't protect Wheaton, Royal Gold, or Franco-Nevada from the impact of commodity price fluctuations. Gold and silver prices will still have an impact on a streamer's top and bottom lines.

Let's talk about yields

Wheaton's yield is around 1.7% today. That's not huge, but it's more than you will get from Franco-Nevada and Royal Gold, which yield around 1.3% and 1.1%, respectively. Wheaton's dividend yield is also higher than those of most major gold miners, including Barrick Gold (0.9%), Newmont Mining (1.4%), and GoldCorp (0.6%).

Stepping back, Wheaton has a business model that's advantaged over gold miners and it has a higher yield than most major gold miners. That sounds like an easy win. And while its business model is roughly similar to its direct streaming peers, Wheaton offers investors a notably higher yield than those peers. That sounds like another win, but don't jump in just yet.

Wheaton has a unique approach to its dividend . Peers Royal Gold and Franco-Nevada have long focused on raising their dividends annually. Royal Gold is up to an impressive 17 years of annual increases, with Franco-Nevada's streak recently hitting 10 years. For many dividend-focused investors, this is the type of dividend consistency being sought out. Wheaton Precious Metals won't provide this kind of regularity.

Wheaton's dividend is intended to vary with the streaming company's performance. The dividend is pegged at 30% of the average cash generated by operating activities over the previous four quarters divided by the number of shares outstanding. In other words, by design, Wheaton's dividend goes up and down over time.

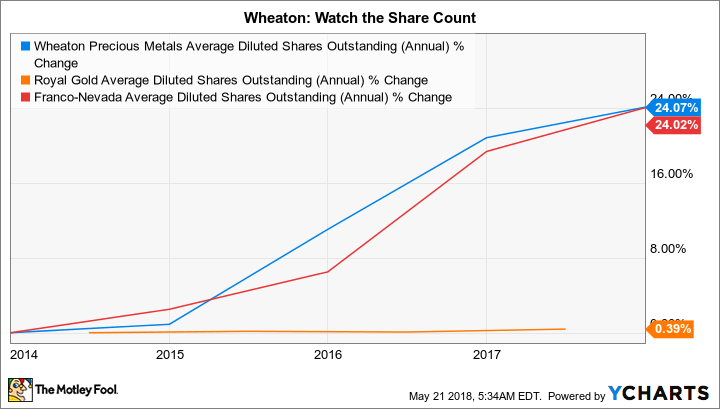

WPM average diluted shares outstanding (annual). Data by YCharts.

There are a number of different factors that can impact this equation. First and foremost are the often-volatile prices of gold and silver as they impact revenue and earnings. Then there's the issue of share count and interest expense. A key part of the streaming business model is to use short-term debt to finance streaming deals and then to permanently finance deals with the sale of stock (which both Wheaton and Franco-Nevada have clearly been doing) or long-term debt obligations (the approach favored by Royal Gold). Long-term bonds will lead to higher interest expenses, reducing cash from operations. And stock issuances will spread results over more shares. But in Wheaton's case that means spreading the 30% of average cash generated over a larger share base, which reduces the dividend per share. Royal Gold and Franco-Nevada have dividends that are set by the board of directors, not by a pre-set equation.

Additional shares aren't as big an issue when Wheaton is inking deals for currently producing assets that bring in revenue from day one. However, like its peers it often invests in mines that are in some stage of development. For example, it provided Barrick Gold with $625 million in late 2009, partially funded by stock sales, to help the mining giant fund the Pascua-Lama mine straddling Chile and Argentina. That mine has faced intense government, environmental, and social pushback and has yet to be built. Because of the unique dividend approach, shares issued for projects that don't work out have a more direct impact on dividends investors at Wheaton.

WPM dividend per share (quarterly) data by YCharts.

Wheaton's dividend history is telling. Even a cursory glance at the chart above will reveal that the dividend varies a great deal from quarter to quarter. There will be times when it is rising quickly, but also when it falls just as dramatically. That's not inherently bad, but it is a fact that you need to understand before you buy Wheaton because of its high yield. Simply put, the dividend behind that high yield may not last.

The best dividend option?

Wheaton isn't a bad way to get exposure to the precious metals industry. Income investors, however, need to understand what they are buying before they step in here based solely on the company's peer-beating yield. If you don't do a little more research, you could end up owning a stock that doesn't live up to your income expectations.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.