Which Mega-Retailer Has the Safer Dividend: Target or Wal-Mart?

Both Target Corporation (NYSE: TGT) and Wal-Mart (NYSE: WMT) had great quarters. Both mega-retailers had strong revenue results and profits, and they did better than most had expected in producing same-store sales growth. In comparison to early expectations for 0.4% at Target and and 1.8% at Wal-Mart, the two retailers reported comps gains of 0.9% and 2.7%, respectively.

However, the fortunes of both companies' stocks could not have been more different. Wal-Mart shares jumped nearly 10% in the post-announcement earnings session, but Target stock fell by a similar amount. The difference was due to guidance: Target projected a worse fourth quarter that investors had expected, while Wal-Mart raised its full-year outlook.

Wal-Mart currently yields 2.3%, while Target yields 4.2%. Should you choose the lower yield with a better forecast or a higher yield with a worse outlook?

Image source: Getty Images

Two rock-solid dividends

Wal-Mart's capacity to pay its dividend is strong. Through the first three quarters, Wal-Mart has generated $10.2 billion in free cash flow, defined as cash from operations minus capital expenditures, while paying out $4.6 billion, or 45%, of generated free cash flow in dividends. The payout ratio will be lower on a full-year basis, as cash from operations typically peaks in the holiday-filled fourth quarter, while cash paid to dividend holders remains similar to prior quarters.

Wal-Mart has approximately $7 billion of cash and cash equivalents on its books, enough to pay a year-plus in dividends even if free-cash flow became unable to support the payment. Finally, the company's management has a strong commitment to the dividend, increasing it every year since 1974. While the price of the stock will vary, investors should consider Wal-Mart's ability and desire to pay dividends rock solid.

If you were to strictly look at free cash flow payouts, Target appears to be able to service its dividend more easily than Wal-Mart. In fact, Target's free-cash flow payout ratio during the comparable period is slightly lower than Wal-Mart's at 42%.

However, Target's management has decided to embark on an aggressive plan to remodel and reinvent its stores, which will ring $7 billion in capital expenditures over the next three years and will most likely increase this ratio in the short term. Still, barring huge shifts in the retail landscape, Target will be able to service and grow its dividend, extending its 49-year streak of annual dividend increases.

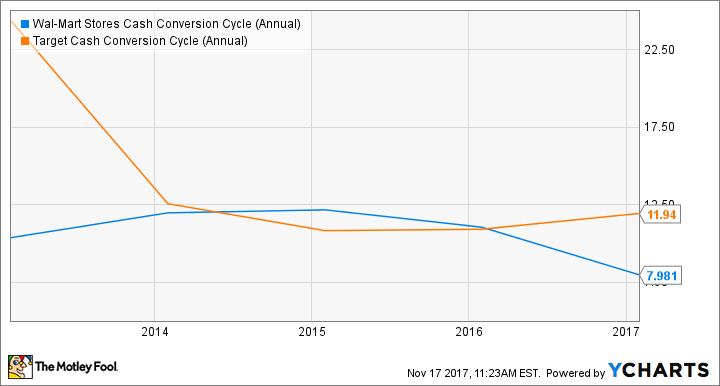

Love dividends? Monitor the cash conversion cycle

For inventory-heavy businesses like retailing, a good rule of thumb for dividend-hungry investors is to monitor the cash conversion cycle. While it's not a perfect metric (what is?), the cash conversion cycle measures how effectively a company is turning inventory into cash. The lower the number, the better, as it shows increased efficiency and cash generation to pay dividends.

If a company's cash conversion cycle sharply increases, it's due to slower inventory turnover, a longer time to collect accounts receivable, or the company's paying (or being forced to pay) accounts payable more quickly. None of these are good news for investors looking for cash dividends, as slower inventory turnover generally portends increased discounts, markdowns, and written-off merchandise, while longer accounts-receivable turnover points to more charge offs and increased use of cash and/or debt to finance new inventory purchases.

WMT Cash Conversion Cycle (Annual) data by YCharts

While Target has a longer cash conversion cycle than Wal-Mart, it has improved over the past five years and is only nominally higher than it was in 2015. The preceding chart shows both companies are doing a good job of managing inventory and turning it to cash.

Which to choose?

If one's investment thesis was solely based on yield, it's simple to say Target is the choice. However, this totally ignores the other reason for owning stock: capital gains. Year to date, shares of Wal-Mart have advanced by 40% while Target has sunk by 21%, as Wal-Mart continues to build on recent successes while Target's turnaround is just starting. Because of Wal-Mart's recent strong performance and Target's remodeling plan, I'm willing to call Wal-Mart a nominally safer dividend pick at this time.

For investors, you have to ask if you should reach for yield with Target in light of the stock's underperformance or accept a lower dividend payout from Wal-Mart, thinking its strong run continues. Either way you go, realize that both have the wherewithal and commitment to continue paying its dividend.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Jamal Carnette, CFA has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.