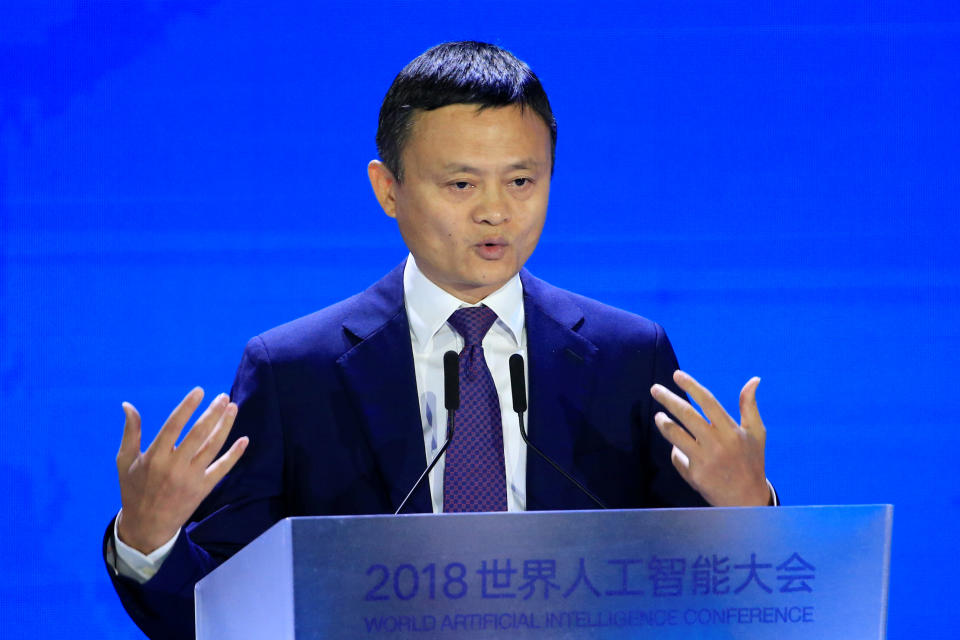

Morning Brief: Jack Ma says Alibaba will not create 1 million US jobs

Thursday, September 20, 2018

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

What to watch today

On Thursday, the economic data calendar will bring investors the weekly report on initial jobless claims, the Philly Fed’s latest reading on manufacturing activity, and the August report on existing home sales. And on the earnings side, Micron Technology (MU) will be the most closely-watched report with the chipmaker set to report results after the market close. Other companies scheduled to report earnings include Thor Industries (THO), Steelcase (SCS), and Darden Restaurants (DRI).

Thursday will also be a big day here at Yahoo Finance as we will host our latest All Markets Summit: A World of Change. Speakers include BlackRock CEO Larry Fink, Chairman of the Council of Economic Advisers Kevin Hassett, former FDIC chair Sheila Bair, Home Depot co-founder Ken Langone, Zillow CEO Spencer Rascoff, and Tinder CEO Elie Seidman, among others.

Top news

Ma says Alibaba no longer plans to create 1M US jobs: Alibaba Group Holding Ltd. (BABA) co-founder Jack Ma said his promise to create 1 million jobs in the U.S. is impossible to fulfill because of the U.S.-China trade war, a setback in one high-profile effort for deeper cooperation between the world’s two largest economies. [Bloomberg]

China plans broad import tax cut as soon as October: China is planning to cut the average tariff rates on imports from the majority of its trading partners as soon as next month, two people familiar with the matter said, in a move that will lower costs for consumers as a trade war with the U.S. deepens.[Bloomberg]

Fox-Comcast bidding war for Sky to enter auction: Fox (FOX-A)and Comcast (CMCSA) are heading for a three-round auction on Saturday to settle a takeover of British broadcaster Sky, the U.K.’s Takeover Panel said. In such auctions, bidders submit secret offers to a third-party arbiter. And while this method is relatively common for commercial transactions, it is extremely unusual when it comes to deal-making for such a high-profile public company. [CNBC]

Amazon mulls opening thousands of cashierless stores by 2021: Amazon.com Inc. (AMZN) is considering a plan to open as many as 3,000 new AmazonGo cashierless stores in the next few years, according to people familiar with matter, an aggressive and costly expansion that would threaten convenience chains like 7-Eleven Inc., quick-service sandwich shops like Subway and Panera Bread, and mom-and-pop pizzerias and taco trucks. [Bloomberg]

Weed is the new blockchain: There’s a new craze in the stock market — cannabis. Over the last few weeks, shares of Tilray (TLRY), a Canadian cannabis company, have become a fascination among investors as the stock has gained more than 700% since being priced at $17 during its July IPO. [Yahoo Finance]

Goldman Sachs nears deal to spin off ‘Simon’ app: Goldman Sachs Group Inc. is nearing a deal to spin off its three-year-old app that sells complex investment products, the bank’s latest bid to profit from its internal technology. The deal being discussed would value Simon at roughly $100 million. [The Wall Street Journal]

Yahoo Finance Originals

Some business owners love the Trump tariffs

A group of HSBC investment bankers call for their boss’s ouster in a scathing memo

China’s Premier reminds the world: ‘China remains a developing country’

Eurasia’s Hirson: ‘How much pain is the president willing to inflict?’

Munson on weed stocks: ‘90% of them are frauds’

—

The Morning Brief provides a quick rundown on what to watch in the markets, top news stories, and the best of Yahoo Finance Originals.