Philip Morris International tries risky move of making cigarettes extinct

Despite sitting atop a tobacco behemoth that is very often the butt of endless criticism from government officials and public health advocates, Philip Morris International CEO André Calantzopoulos doesn’t think his job is too different from other leading executives.

“Look, I don’t think there is any business that isn’t tough. Business is about change and dealing with unknown things and I don’t think I have the unique privilege of being in a different position than my fellow CEOs,” Calantzopoulos explained in an interview with Yahoo Finance when asked about his seemingly challenging role.

Perhaps.

But that doesn’t mean Calantzopoulos’s grand vision of creating a world without cigarettes – one he calls a “smoke-free future” – will be easy to execute for the Marlboro seller. After all, navigating the watchful eyes of governments globally with new products and surviving the 24/7 attacks from TV ads on traditional cigarettes will be vastly more difficult than launching a new clothing line on the web and seeing it take off overnight. (Philip Morris International was spun off from Altria in 2008, and licenses names such as Marlboro to sell overseas. Philip Morris USA, a division of Altria, is based in Virginia and sells Marlboro, Virginia Slims and L&M in the U.S.)

Seeing news Tuesday of a government raid on the headquarters of vaping company Juul Labs doesn’t make Philip Morris International’s turnaround efforts any easier, either.

Adapting to a cigarette-less world

So far, Philip Morris International has seen some momentum behind the push to evolve in an increasingly anti-cigarette world. And company executives used their pulpit at a Sept. 27 investor day to try and persuade an anxious Wall Street that progress is being made.

The company says that 5.8 million adult smokers have quit their bad habit and switched to a new “reduced risk” product called IQOS. Philip Morris wants to use its new IQOS device, which heats tobacco without combustion, to convert the 1 billion people worldwide still puffing away on cigarettes.

IQOS is marketed in Europe, Japan and other international markets primarily under the HEETS label.

Two applications are pending with the FDA regarding the sale of IQOS in the U.S. If approved, it would be a big boost for Philip Morris in the U.S. market.

While IQOS shipment volume rose 5.5% in the second quarter in the key market of Japan, market share fell sequentially, by 0.3%, for the first time. And IQOS market share rose a modest 0.7% sequentially in Korea amid a barrage of negative ads on the health concerns of reduced risk products.

“It’s challenging to achieve a smoke-free future, but I don’t think it’s a dream,” Calantzopoulos says, adding that he uses the IQOS device. “It has been my dream to get these kinds of products to market. If we are successful in this transformation, we will be a much better organization and a much more modern organization than we were.”

Industry experts Yahoo Finance spoke with are mixed on tobacco players such as Philip Morris and R.J. Reynolds being able to end cigarette use and profit from e-cigarettes and vape gadgets.

“They [tobacco industry] think they will transition to other products, and I don’t accept that proposition,” says tobacco industry historian and Middle Tennessee State University professor Louis Kyriakoudes. “You have IQOS and vaping products being pitched by tobacco companies as safer than combustible cigarettes, but all of them are drug delivery devices and cause injury of addiction. They are inherently dangerous and are not safe.”

By the numbers

Even with the well-entrenched skeptics, Phillip Morris’s business model pivot makes sense based on the data alone.

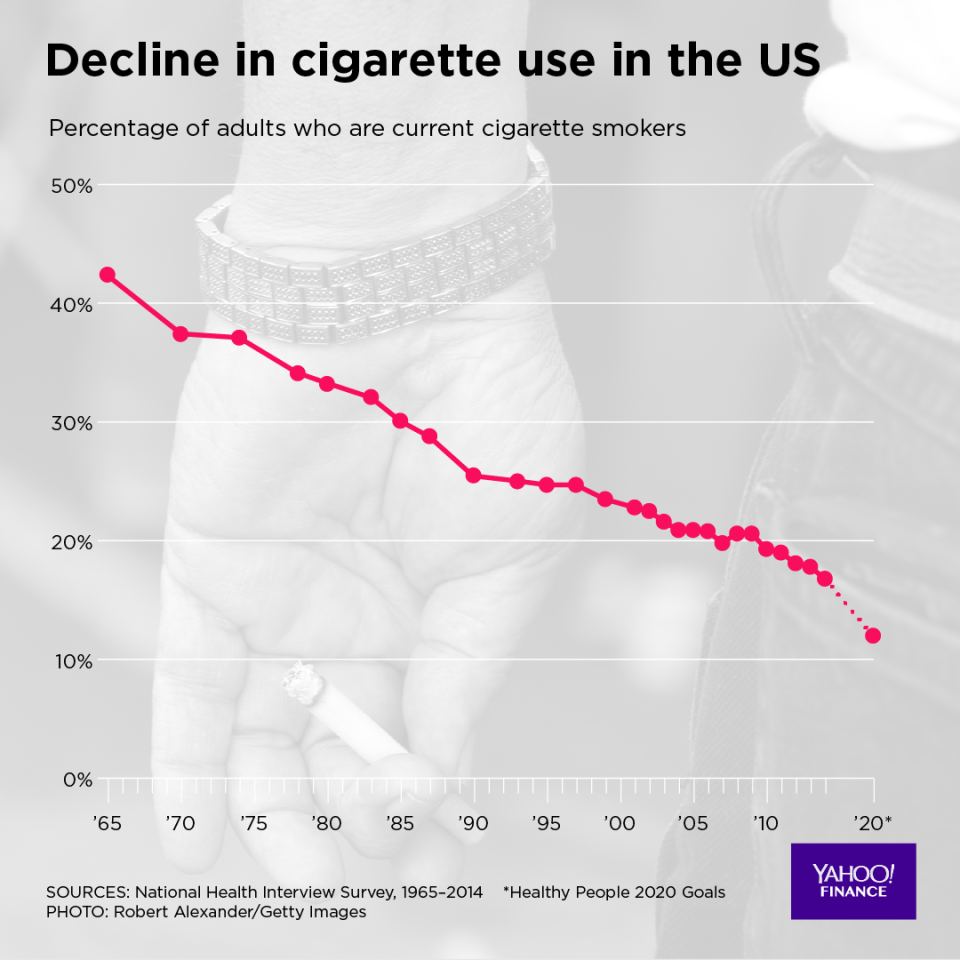

About 14% of U.S. adults were smokers last year, down from roughly 16% the year prior, according to the latest data from the CDC. In the early 1960s, more than 40% of U.S. adults smoked. The number of smokers worldwide fell by 29 million from 2000 to 2015, per the most recent data crunched by the World Health Organization.

The aforementioned Juul sold 16.2 million of devices last year, according to data released Tuesday by the Centers for Disease Control and Prevention. In 2016, Juul saw sales of 2.2 million.

Meanwhile, the e-cigarette and t-vapor market was estimated at $11.43 billion in 2016, according to BIS Research. The market is seen surging to $86.4 billion by 2025 as more people give up cigarettes and turn to something marketed as safer.

So it’s either Philip Morris International and the like take a stab at changing today or risk extinction in the future. “Aligning your business with health puts you in a really good spot,” said Gerry J. Roerty, Jr., vice president and general counsel of tobacco seller Swedish Match North America. “The consumer is awfully resistant, though, so you have to give them a reason to move to other products.”

Wall Street needs to be won over

The transition away from cigarettes has weighed on Philip Morris. Shares tumbled 16% on April 25 when the company reported mixed first-quarter earnings. That marked the biggest one-day drop since the Altria spinoff as first-quarter cigarette shipments fell by 5.3%, as important markets, like Japan, Russia and Saudi Arabia, saw weak performance.

The second quarter brought slight relief with cigarette volumes off by 1.5%. But the stock stayed under pressure for most of the summer, only recovering a bit of ground following the company’s investor day presentation last month.

“I think it [market reaction] is exaggerated, but as the results come in, it will correct,” says Calantzopoulos. Said Kyriakoudes, “If I was an investor looking for the best return, I would be very wary of the tobacco industry as the market is shifting rapidly.”

It does appear Wall Street may be finally warming to Philip Morris as a cost-cutting play that continues to offer an attractive dividend. Calantzopoulos told investors during the presentation he will cut $1 billion in costs by 2021. That’s fresh off hiking the dividend by a solid 6.5% in June, marking the 11th consecutive year of a dividend increase.

The dividend yield on Philip Morris is now a heady 5.8%.

“We appreciated Philip Morris’s candor about the challenges it faces in pioneering a potentially revolutionary lower-risk alternative to cigarettes and its decision to set measured (we think safely achievable) mid-term [financial] targets given the inherent volatility of reduced risk products presently,” Wells Fargo analyst Bonnie Herzog wrote in a note after the investor gathering. Herzog says Philip Morris is one of her top picks.

Others think the market is neglecting the company’s still nicely profitable core cigarette business.

“Philip Morris is an undervalued opportunity. The market is discounting the core growth in the cigarette business and giving zero credit to the potential in reduced risk products,” Stifel Nicolaus tobacco industry analyst Chris Growe told Yahoo Finance.

Says Calantzopoulos, “If we are successful with these new products as I think we will be, at the end of the day the vision is that there will be no cigarettes.”