Renewed concerns about inflation has the Fed triggered

This post was originally published on TKer.com.

It’s a bear market.

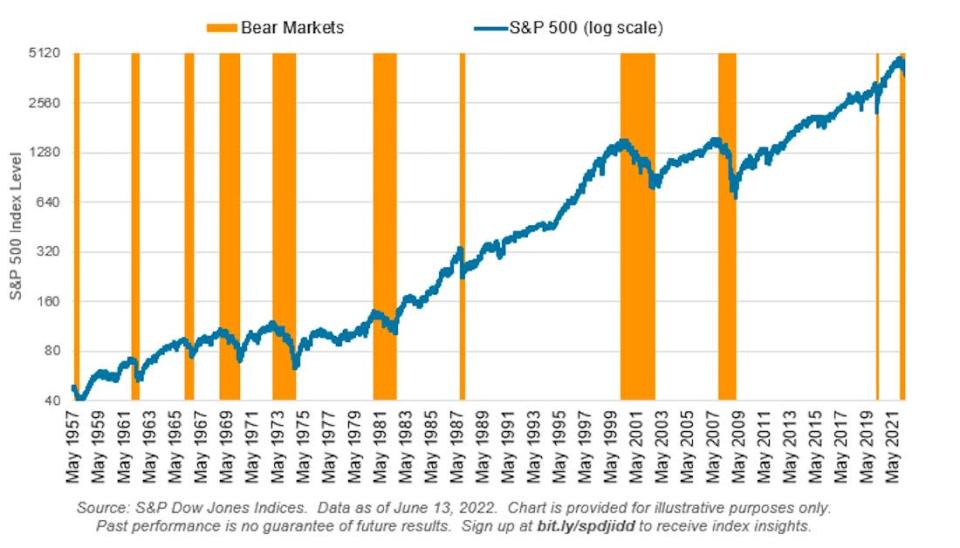

On Monday, the S&P 500 tumbled 3.9% to close at 3,749.63. That put the index down 21.8% from its January 3 all-time closing high of 4,796.56. This was the first time the S&P closed down by at least 20% from its high, confirming that we’ve been in an official bear market.

By the end of the week, the S&P had fallen to 3,674.84, down 23.4% from its high.

Historically, bear markets have come with more pain. According to Howard Silverblatt of S&P Dow Jones Indices, the average bear market has lasted 18.6 months and has seen the S&P 500 fall 38.3% before bottoming.1 The ones that came with economic recessions tended to be worse. Though, it’s not crazy to think this could be a bear market without a recession.

While the stock market is likely to generate healthy returns in the long run, there’s good reason for investors to manage expectations in the short run as the Federal Reserve gets increasingly aggressive with monetary policy.

‘The worst mistake we could make‘ 🦅

The stock market’s recent sharp declines came in the wake of the May consumer price index report — released on June 10 — which was much hotter than expected. The news intensified worries about inflation persisting and renewed calls for a more hawkish Federal Reserve.2

And the hits kept coming last week.

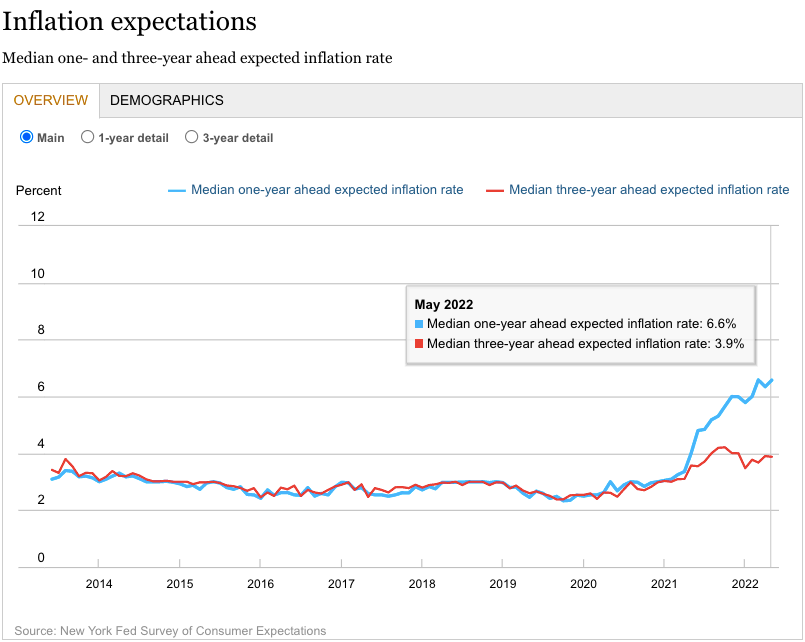

The New York Fed’s May Survey of Consumer Expectations released Monday confirmed that the inflation we’ve been experiencing today has folks increasingly convinced that inflation is likely to remain elevated down the road. The median expectation for inflation one year ahead was 6.6% in May. This tied the highest reading (March) since the survey’s inception in June 2013.3

On Tuesday, we learned that producer price growth in May accelerated to 0.8% from April. This reflected a worrisome 10.8% gain from a year ago. Excluding food and energy prices, which tend to be much more volatile in the short-run, core PPI was up 0.5% for the month and 8.3% for the year. Prices for both goods and services rose at an increasing rate.

Also on Tuesday, the National Federation of Independent Business reported that its small business Optimism Index in May fell to its lowest level since April 2020 as inflation concerns persisted. From the report: “The net percent of owners raising average selling prices increased 2 points from April to a net 72% seasonally adjusted (the same as March 2022 and a record high reading).“

To be clear, none of these metrics reflect sudden and sharp deteriorations. They’ve been trending unfavorably for months.

The issue right now is that they continue to show little or no improvement despite months of tighter monetary policy from the Fed. We’re not close to seeing “clear and convincing” evidence that inflation is cooling, which the Fed needs to see before it will let up on tightening monetary policy.

This is why on Wednesday, the Fed unleashed a very aggressive 75 basis point interest rate hike, the biggest rate hike since 1994.

“We have to restore price stability,” Fed chairman Jerome Powell said on Wednesday. “It’s the bedrock of the economy. If you don’t have price stability, the economy is not going to work as it's supposed to.”

"The worst mistake we could make would be to fail [on lowering inflation],” he said. “We have to restore price stability. We really do."

The stock market’s conundrum 😵💫

None of this is great news for those hoping for a sustained recovery in the financial markets to begin soon.

The Fed wants tighter financial conditions, and a robust stock market rally would be the opposite.

Powell all but confirmed that the Fed was hoping for a bear market.

“Over the course of this year, financial markets have responded and have generally shown that they understand the path we're laying out,” he said Wednesday.

Vickie Chang, global markets strategist at Goldman Sachs, explained this dynamic on Tuesday (emphasis added):

“The recent market correction has been a Fed-driven one, as equities have steadily priced in more tightening this year while simultaneously worrying that such front-loaded tightening will ultimately lead to a policy reversal. Our US economists also do not see major financial imbalances of the sort that led to the retrenchment episodes of the 2000s. So, for equities to recover in a sustained way, history suggests that this kind of monetary tightening-induced contraction is most likely to end when the Fed shifts policy direction. While a shift towards Fed easing is unlikely without an outright move into recession, as in late 2018, a clear signal that tightening risks are receding may be sufficient.”

And so until inflation shows signs of letting up, investors should manage their expectations for near-term returns. (Read more about the stock market’s conundrum here.)

The good news is we continue to get bad news about the economy 🙃

In recent weeks, we’ve been getting lots of evidence that economic growth has been decelerating. Notably, there’s been some indications that the labor market is a little less hot than it used to be. It’s the kind of bad economic news that should be good news for the effort to bring down inflation.

This past week came with more data reflecting an economic slowdown.

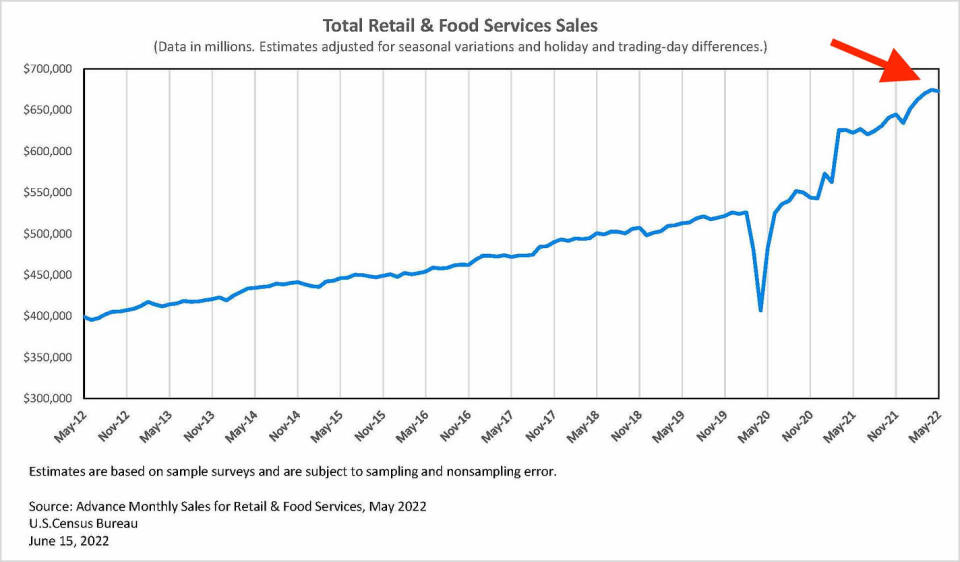

Notably, on Tuesday we learned retail sales unexpected fell by 0.3% in May.

Motor vehicle and parts sales declined. Furniture and home furnishings sales declined. Electronics and appliance sales declined. Health and personal care store sales declined. Online retail sales declined. The pattern is clear.

Meanwhile, manufacturing has been cooling.

Industrial production climbed by a slower-than-expected 0.2% in May. Manufacturing output unexpectedly declined by 0.1%.

Regional surveys suggest manufacturing activity continued to deteriorate into June.

According to the Empire State Manufacturing Survey released Wednesday, the report’s general business conditions index came in at -1.2 in June, up from -11.6 in May. Yes, it may be an improvement, but any negative number signals a contraction in manufacturing activity in New York.

According to the Philly Fed Manufacturing Business Outlook Survey released Thursday, the general activity index fell 6 points to -3.3 in June. It was the first negative reading since May 2020.

There were also more signs that the labor market is cooling.

From labor market data firm Linkup: “For the second month in a row, LinkUp data reveals job listings on company websites were down, with overall listings dropping 4.2% in May… At the industry level, companies with the largest drops in job listings in May include those in: Utilities (-8.8%); Information (-7.3%); and Transportation and Warehousing (-6.8%)…“4

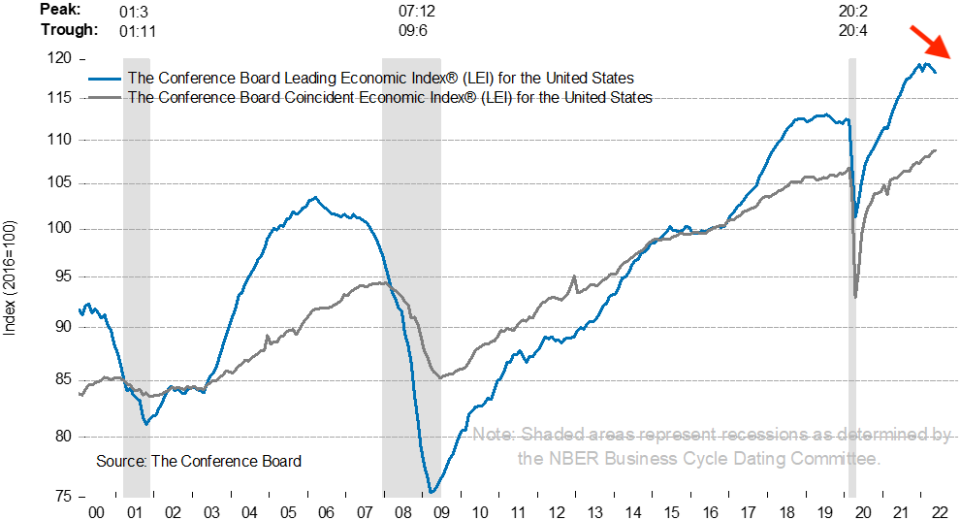

The Conference Board’s Leading Economic Index5, which offers a more comprehensive forward-looking view of the economy, fell for the third straight month.

“The index is still near a historic high, but the US LEI suggests weaker economic activity is likely in the near term — and tighter monetary policy is poised to dampen economic growth even further,” The Conference Board’s Ataman Ozyildirim said on Friday.

And while a lot of metrics have begun to turn south, the Fed continues to believe it can tighten monetary policy without sending the economy into recession.

“We’re not trying to induce a recession now,” Powell said on Wednesday. “Let’s be clear about that.”

That said, the deteriorating data is a reminder of what Powell said in May: “There could be some pain involved in restoring price stability.“

The bad news is there’s still good news about the economy

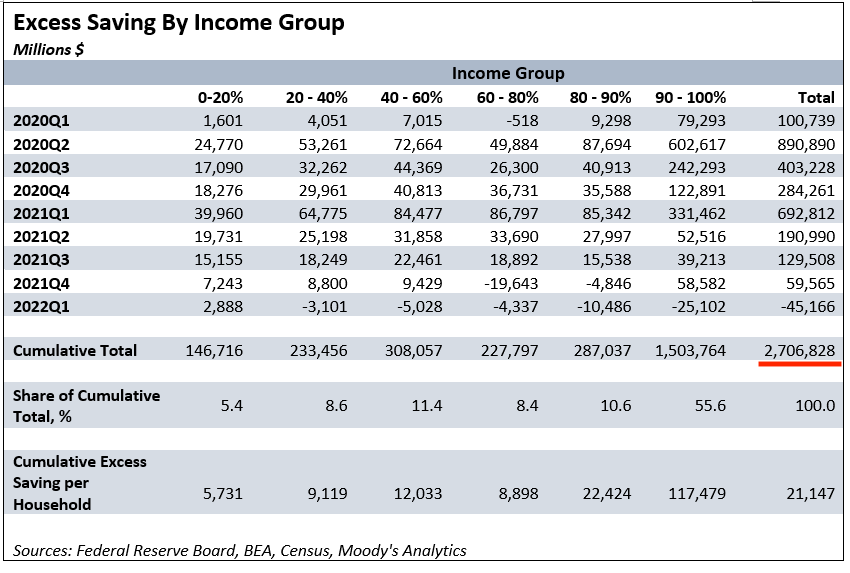

One of the biggest tailwinds in the economy is the massive amount of excess savings that consumers accumulated during the pandemic.

According to Moody’s Analytics’ Mark Zandi, consumers are sitting on about $2.7 trillion worth of excess savings.

Sure, these savings are good in that they’ve helped consumers pay up for goods and services. And they’re helping to prevent any economic slowdown from becoming economic calamity.

Unfortunately, these savings have also been a curse in that they’re enabling businesses to raise prices amid tight supply. In other words, it’s one of the reasons why inflation is so high.

The supply wildcard 🃟

Keep in mind that the Fed’s ultimate goal isn’t to slow the economy. Its ultimate goal is to cool inflation. Using policy tools to slow the economy is just a means to achieve those ends.

This is an important nuance because a slowdown in demand isn’t the only path to lower inflation. An improvement on the supply side can get us there too.

And there have been some signs of improvement in supply.

According to Census Bureau data released Wednesday, inventory levels — as measured by the business inventories / sales ratio — looked a little less depleted as of April.

One of the most intuitive measures of supply chain health is supplier delivery times, which had become very long.

However, this month’s regional manufacturing surveys suggest delivery times have gotten shorter. (H/T @RenMacLLC):

Delivery times appear to be returning to levels seen before everyone started freaking out about supply chains.

If it is the case that supply is catching up, then we should soon see inflation come down. This would be a particularly good scenario because it’d mean demand doesn’t have to come down significantly.

Zooming out

While many corners of the economy are slowing all at once, it’s important to remember that most of the slowing metrics are still near record levels. So a recession right now would bring the economy down from very strong levels to slightly less very strong levels.

And if the economy is indeed slowing down and supply chains are indeed improving, then we should soon see prices cooling off or even coming down. This is key because the Fed has been very clear that it will not let up on tightening monetary policy until it sees “clear and convincing” evidence that inflation is easing.

Until we get that evidence, don’t expect stock market to go on a sustained rally.

It’s worth remembering, however, that Powell has repeatedly said that the Fed will move “expeditiously” in its fight to restore price stability. That means that the Fed can decide to ease up as quickly as it decided to tighten up last week.

Related from TKer:

The 'too hot' jobs market has gotten a little more 'just right' 🍲

SPECIAL EDITION: The complicated mess of the markets and economy, explained 🧩

Recap 📋: For a little over a year, the rapid economic recovery came with demand growth sharply outpace supply, causing inflation rates to rise. However, supply has failed to catch up, which is why the Federal Reserve has been tightening monetary policy in its effort to bring down inflation by cooling demand. While economic growth has indeed been slowing in recent months, high inflation persists. And now we have an even more hawkish Fed putting even more pressure on the economy, and it’s doing so by targeting the financial markets.

Rearview 🪞

📉 Stocks plunge: The S&P 500 fell 5.8% last week to close at 3,674.84. It was the worst week since March 2020, and it’s been the third worst start to a year in history. The index is now down 23.4% from its January 3 closing high of 4796.56 and just marginally above its June 16 closing low of 3,666.77. For more on market volatility, read this and this. If you wanna read up on bear markets, read this.

As I mentioned briefly above (and wrote on Monday), it appears that the markets will be held hostage by the Fed as long as inflation isn’t showing “clear and convincing” signs of easing. Read more about this here and here.

📆 Last week in the economy: We got the May retail sales report, May industrial production report, May producer price index report, May survey of consumer expectations from the Fed, May leading economic index, and April business inventories report. I addressed all of these above.

📈 Mortgage rates surge: The average rate for the 30-year fixed rate mortgage jumped to 5.78% from 5.23% the week prior. Here’s Freddie Mac: “Mortgage rates surged as the 30-year fixed-rate mortgage moved up more than half a percentage point, marking the largest one-week increase in our survey since 1987. These higher rates are the result of a shift in expectations about inflation and the course of monetary policy. Higher mortgage rates will lead to moderation from the blistering pace of housing activity that we have experienced coming out of the pandemic, ultimately resulting in a more balanced housing market.“

Up the road 🛣

Fed chair Powell will appear before the Senate Banking Committee on Wednesday at 9:30 am ET and the House Financial Services Committee on Thursday at 10 am ET to give central bank’s semiannual Monetary Policy Report. There’ll be Q&A, which means there’s likely to be lots of talk about the Fed’s views on inflation and where it’s headed.

The May existing home sales report released on Tuesday and the new home sales report released on Friday. Both are expected to reflect what appears to be a cooling housing market.

U.S. financial markets will be closed on Monday for Juneteenth.

1. Here’s a snapshot of history’s bear markets, courtesy of Silverblatt:

And for good measure, here’s a snapshot of history’s bull markets:

2. A more aggressive Fed means tighter monetary policy, which means tighter financial conditions. And one of the more prominent and immediate manifestations of tighter monetary policy is lower stock market valuations. As such, the persistence of high inflation is a real conundrum for the stock market.

3. Expectations for inflation three years ticked lower, but uncertainty about those expectations has been climbing

4. Keep in mind that the Fed specifically indicated that it wants the level of job openings to come down, because it should help bring wage growth down, which in turn should help inflation come down.

5. Here’s more detail from the Conference Board: “The LEI is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months… The ten components of The Conference Board Leading Economic Index® for the U.S. include: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers’ new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers’ new orders for nondefense capital goods excluding aircraft orders; Building permits for new private housing units; S&P 500® Index of Stock Prices; Leading Credit Index™; Interest rate spread (10-year Treasury bonds less federal funds rate); Average consumer expectations for business conditions.”

This post was originally published on TKer.com.

Sam Ro is the founder of Tk.co. Follow him on Twitter at @SamRo

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube