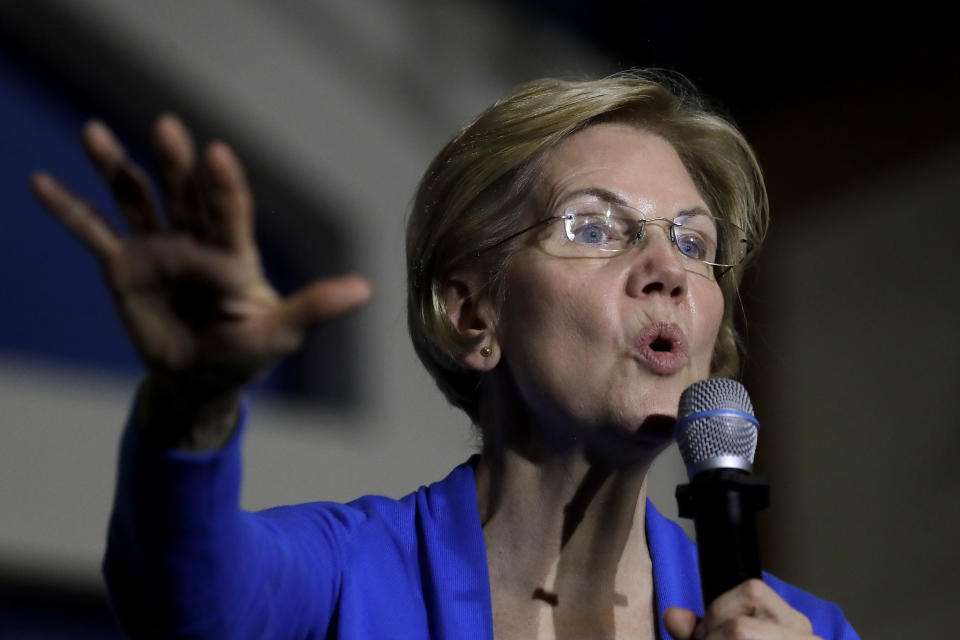

Senators Elizabeth Warren and Bernie Sanders get a message from this private equity titan

The private equity business model is getting a bad rap from Democratic presidential hopefuls Elizabeth Warren and Bernie Sanders, says one of the industry’s most influential names.

“What the misinformation is is that private equity comes in there and cuts costs, actually you don’t make any money when you cut costs in an era where multiples are high. People want to buy growth businesses, there is not a lot of multiple expansion left. So you have to fundamentally grow the businesses. So that’s really counter to what is being said out there,” Bain Capital co-chairman Steve Pagliuca told Yahoo Finance in an interview at the World Economic Forum.

Pagliuca was responding to a question by Yahoo Finance Editor-in-chief Andy Serwer on the attacks by Warren and the likes on private equity’s practices. Some of those practices include, according to many in the finance industry and government, not paying enough in taxes and firing people at acquired companies to earn fatter returns on investment.

Pagliuca was quick to note Bain Capital’s acquired companies have grown revenue two times faster than S&P 500 components and have created 1.1 million more jobs since being bought by the private equity shop.

Despite Pagliuca’s assertions, the private equity industry — replete with more than 4,000 shops and trillions of dollars in assets under management —is likely to stay in the crosshairs of Warren and Sanders. In fact, Warren has developed a controversial plan to overhaul the private equity industry.

Dubbed the Stop Wall Street Looting Act, Warren proposes that private equity firms are banned from charging management fees and passing on debts to acquired companies. Both practices have been criticized for years as hurting employees at companies private equity shops buy, while enriching the sponsors.

Meanwhile, the bill would alter tax and bankruptcy laws to prevent lenders from making high-risk loans to companies burdened with debt (these loans have long been key for PE firms to finance deals). It would also close the carried interest loophole that has allowed private equity shops to pay lower taxes on profits at acquired businesses.

As for Sanders, he has been more bluster than action on the private equity reform front. Sanders famously attacked Bain Capital in 2018 for the demise of one its most visible investments, the now bankrupt Toys R Us.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Watch The First Trade each day here at 9:00 a.m. ET. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Read the latest financial and business news from Yahoo Finance

Microsoft CEO Satya Nadella on the future of retail

4 major concerns investors have about the stock market in 2020

Trump's tax plan will hurt restaurants again in 2020: Dunkin' chair

Watch: Target is Yahoo Finance’s ‘Company of the Year’

Beyond Meat founder: things are going very well with McDonald’s

Starbucks CEO on what China has in store for the coffee giant

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.