UPS Q3 Earnings Beat, Rise Y/Y on Solid Average Daily Volumes

United Parcel Service’s UPS third-quarter 2020 earnings (excluding 4 cents from non-recurring items) per share of $2.28 surpassed the Zacks Consensus Estimate of $1.86. The bottom line also improved 10.1% year over year. Results were aided by expanded residential delivery volumes amid the coronavirus pandemic, which confined people to their homes, and strong outbound demand from Asia.

UPS generated revenues worth $21,238 million in the quarter, outpacing the Zacks Consensus Estimate of $20,079.6 million. Moreover, the top line improved 15.9% on a year-over-year basis, driven by growth across all segments. Results were aided by 13.5% growth in consolidated average daily volumes. Also, operating profit climbed 9.9% on an adjusted basis in the third quarter owing to a robust rise in International Package segment’s adjusted operating profit.

UPS did not provide consolidated revenue and earnings per share guidance due to the uncertainty revolving around the timing and pace of the economic recovery. The company’s refusal to issue any outlook might have disappointed investors. Consequently, UPS shares declined in early trading despite outperforming on both counts (earnings as well as revenues).

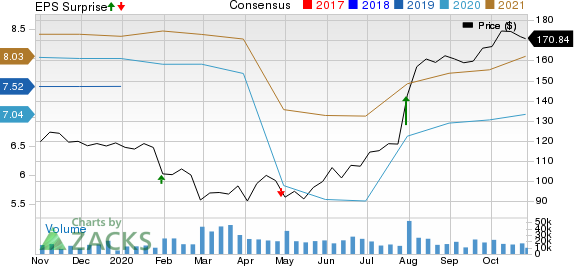

United Parcel Service, Inc. Price, Consensus and EPS Surprise

United Parcel Service, Inc. price-consensus-eps-surprise-chart | United Parcel Service, Inc. Quote

Segmental Details

U.S. Domestic Package revenues increased 15.5% year over year to $13,225 million in the third quarter, driven by a 13.8% rise in average daily volumes on the back of elevated residential demand. Segmental operating profit (adjusted) decreased 8.8% to $1,133 million in the quarter. Adjusted operating margin in the September quarter was 8.6%.

Revenues at the International Package division summed $4,087 million, up 17%. Average daily volumes rose 12.1%. Segmental results were aided by the double-digit export volume expansion across the globe and strong outbound demand from Asia. Segmental operating profit (adjusted) totaled $972 million in the reported quarter, up 40.3%.

Supply Chain and Freight revenues climbed 16.5% to $3,926 million owing to higher demand for air freight forwarding from Asia. Operating profits (on an adjusted basis) increased 18% to $302 million in the September quarter.

Other Details

Cash from operations were $9.3 billion at the end of the first nine months of 2020. UPS, currently sporting a Zacks Rank #1 (Strong Buy), also generated free cash flow of $5.9 billion on an adjusted basis in the same period. The company’s capital expenditures (adjusted) were $3,355 million at the end of the first nine months of 2020.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Sectorial Snapshots

Let’s look into some other Zacks Transportation sector participants’ third-quarter earnings.

Southwest Airlines LUV incurred a loss of $1.99 per share (excluding 3 cents from non-recurring items) in the third quarter of 2020, narrower than the Zacks Consensus Estimate of a loss of $2.44. Moreover, operating revenues of $1,793 million surpassed the Zacks Consensus Estimate of $1,678.2 million.

Trinity Industries Inc TRN delivered third-quarter 2020 earnings (excluding 4 cents from non-recurring items) of 17 cents per share, comprehensively surpassing the Zacks Consensus Estimate of 5 cents. Total revenues of $459.4 million also outperformed the Zacks Consensus Estimate of $443.8 million.

CSX Corporation CSX reported third-quarter 2020 earnings of 96 cents per share, surpassing the Zacks Consensus Estimate of 93 cents. However, total revenues of $2,648 million lagged the Zacks Consensus Estimate of $2,704.6 million.

Zacks’ 2020 Election Stock Report:

In addition to the companies you learned about above, we invite you to learn more about profiting from the upcoming presidential election. Trillions of dollars will shift into new market sectors after the votes are tallied, and investors could see significant gains. This report reveals specific stocks that could soar: 6 if Trump wins, 6 if Biden wins.

Check out the 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

CSX Corporation (CSX) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research