Why Avon Products Stock Plunged 57% in 2017

What happened

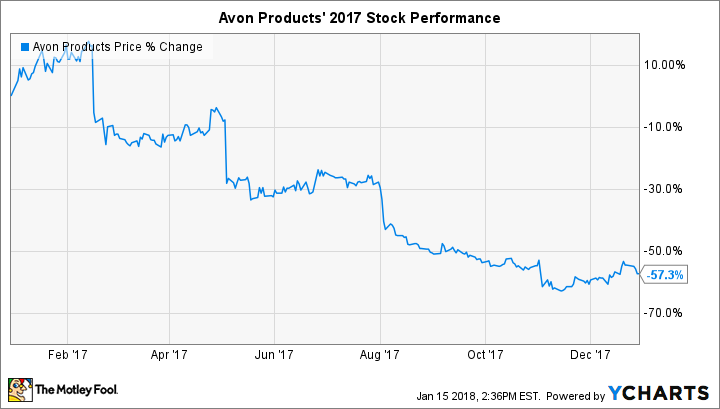

Beauty product specialist Avon (NYSE: AVP) shed 57% last year, according to data provided by S&P Global Market Intelligence, compared to a 19% increase for the broader market.

The slump pushed the stock to a multi-year low, down over 80% since early 2013.

So what

Avon delivered a series of disappointing earnings reports in 2017 that, together, suggest its turnaround strategy will take longer than Wall Street had hoped. Sales barely met management's targets in the first quarter, dipping 1% after accounting for foreign currency shifts. Profitability dove, though, falling to 2.2% of sales from 3.8% a year ago.

Image source: Getty Images.

Demand trends didn't improve much from there, leading management in early November to lower its operating outlook for the second consecutive quarter.

Now what

CEO Sheri McCoy is stepping down to make room for new leadership as Avon enters the third year of a recovery plan that hasn't yet produced consistent profits or accelerating sales growth. The direct selling retailer noted hints of improved demand in pockets of its global network of representatives at the start of the holiday quarter, but investors shouldn't expect to see a dramatic growth rebound. Instead, a sluggish makeup industry is likely to keep pressuring profits and sales as Avon shops around for fresh leadership in 2018.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.