Why You Should Hold on to Continental Resources Stock Now

Continental Resources, Inc. CLR is well poised to grow on the back of strong presence in the Bakken Shale. However, rising production costs and a volatile commodity price environment are persistent concerns.

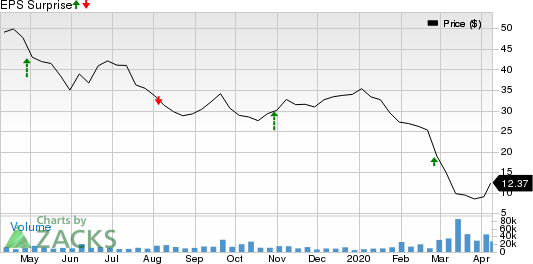

Oklahoma City, OK-based Continental Resources is an explorer and producer of oil and natural gas. The company has resources across the East, South and North regions in the United States. It is a leading producer in the Bakken play. It has a market cap of $4.5 billion and an expected earnings growth rate of 8.5% for the next five years. Notably, the company beat earnings estimates thrice in the last four quarters, with average positive surprise of 12.6%.

Continental Resources, Inc. Price and EPS Surprise

Continental Resources, Inc. price-eps-surprise | Continental Resources, Inc. Quote

Let’s delve deeper to find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

What’s Favoring the Stock?

Continental Resources has a premier position in the Bakken area. The shale play, which is ranked among the country’s largest onshore oilfields, produces premium quality of crude. In the said region, the company produced 148,416 barrels of oil per day in 2019, representing a year-over-year rise of 14%. Moreover, its operations in the SCOOP and STACK plays of Oklahoma generate huge profits for the company.

From 2019 to 2023, it expects oil equivalent production to see a compound annual growth rate (CAGR) of 8-10%. This will likely help the company generate average annual free cash flow of $3.5-$4 billion over a five-year period. Notably, it has decided to suspend quarterly dividend payouts to maximize cash flows amid the current market uncertainty.

Despite Continental Resources’ plan of reducing 2020 capital budget by a massive 55% from its original guidance — which indicated no change from 2019 levels — due to the weak crude pricing environment, production is likely to decline only 5% year over year. This is indicative of rising efficiency in the company’s operations. Moreover, Continental Resources’ strategic water assets add huge value to its operations in Bakken and Oklahoma.

Downsides

However, there are a few factors that are impeding the growth of the stock lately.

As of Dec 31, 2019, the company had total cash and cash equivalents of only $39.4 million, while the total debt balance was way higher at $5.3 billion. In fact, the company had a debt-to-capitalization ratio of 42.8%, higher than the energy sector’s 31%. In other words, Continental Resources’ balance sheet is more levered than the sector, restricting the stock’s financial flexibility and limiting its growth compared with the industry.

As commodity prices are now in the bearish territory since the coronavirus pandemic is hurting global energy demandand the market is oversupplied, the outlook for exploration and production business seems gloomy. With crude accounting for the majority (58.2%) of the company’s production volumes, the weakness in the price of the commodity is likely to hurt the upstream energy player’s bottom line.

Continental Resources’ production expenses rose 14% in 2019. Exploration expenses also doubled in 2019, in turn affecting the company’s bottom line. If the current situation persists, its profit levels will be hurt in the coming quarters.

To Sum Up

Despite significant growth opportunities, increasing production costs and volatile commodity prices are concerns. Nevertheless, we believe that systematic and strategic plan of action will drive its long-term growth.

Stocks to Consider

Some better-ranked stocks in the energy sector are Murphy USA Inc. MUSA, FuelCell Energy, Inc. FCEL and Covanta Holding Corporation CVA, each holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Murphy USA’s bottom line for 2020 is expected to rise 7.7% year over year.

FuelCell’s bottom line for 2020 is expected to rise 70.8% year over year.

Covanta Holding beat earnings estimates thrice in the last four quarters, with the average positive surprise being 55%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

FuelCell Energy, Inc. (FCEL) : Free Stock Analysis Report

Covanta Holding Corporation (CVA) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research