The 1 Place Where Amazon.com Keeps Stumbling

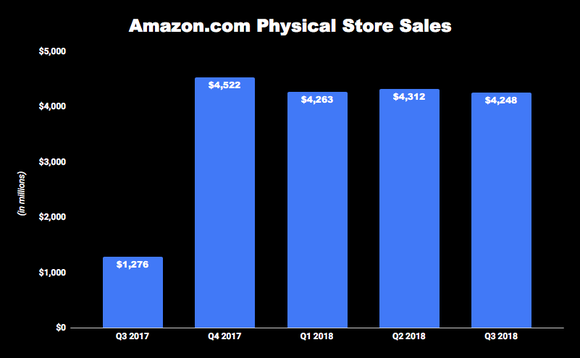

An omnichannel sales presence is only just becoming an integral part of the Amazon.com (NASDAQ: AMZN) retail experience, but so far it hasn't been a ringing success. Amazon's most recent quarterly report showed that for the second time in the last three quarters, Amazon recorded lower sales sequentially at its physical store locations

Amazon closed its purchase of Whole Foods Market late in the third quarter of 2017, so we will only get year-over-year comparisons starting next quarter, but combined sales at the grocery store, its cashier-less Amazon Go stores, Amazon 4-Star, Amazon Books, and a variety of pop-up outlets fell 1.5% from the second quarter to $4.25 billion in the third quarter, the lowest point so far this year.

Despite building out a physical store footprint, sales are largely stagnant. Image source: Amazon.com.

Not physically fit

The market was less than excited by Amazon's overall performance this quarter, despite revenue rising 30% in the third quarter and earnings surging to $5.75 per share. Amazon's stock tumbled because guidance for the coming quarter showed only 15% sales growth, one of the e-commerce retailer's lowest increases in years.

It's certainly not getting much support from the physical store footprint it's building out. There are 492 Whole Foods locations in North America and the U.K., 18 Amazon Books stores, six Amazon Go stores, one Amazon 4-Star outlet, and 86 Amazon Pop-Up sites. That gives the e-tailer 603 physical locations, with another Books and 4-star store on the way. Amazon also reportedly wants to open some 3,000 Amazon Go convenience stores by the end of 2021.

Yet since it acquired Whole Foods, and despite the addition of these other outlets (albeit many being small experimental types), physical store sales have been fairly stagnant.

Data source: Amazon.com Q3 SEC filing. Chart by author.

The physical format is still a small part of Amazon.com's overall total and a fraction of the $29.1 billion it generates in online sales, but the brick-and-mortar component was supposed to be a growth channel for the company, as consumers still want to shop in stores, not just online. As many retailers have figured out, an omnichannel approach that lets consumers buy where they want, when they want, and how they want is best.

While traditional retailers have mostly all added an online presence to their operations, and oftentimes it is the fastest-growing part of their business, it doesn't seem to be working the other way around for Amazon (though it is still early in the process).

Where bricks can meet clicks

There is obviously an opportunity to leverage Amazon's massive digital presence with its nascent brick-and-mortar footprint. For example, it has added its Lockers for online order pickup to many Whole Foods supermarkets, and has extended the many benefits and discounts available from its Prime member loyalty program to customers shopping at Whole Foods.

Further blending of the physical and the digital came when Amazon adding Whole Foods discount brand 365 by Whole Foods to its online supermarket as soon as it closed on the $13.7 billion deal, and Whole Foods also has opened its own storefront on Amazon.

Prime members also get special pricing at the Books stores, as well as at the new 4-Star location, which only sells items that have been rated four stars or higher on Amazon.com by people in the surrounding community.

Amazon also has a number of physical locations set up where customers can either pick up their order if they don't want it sent to their house (the concept behind the Lockers) or where they can return their order, like the partnership it has with Kohl's. It's also opened a number of pop-up locations inside Kohl's that sell its Echo devices and other Alexa-enabled products.

Investor takeaway

Yet for all the Amazon physical locations where you can actually buy something, sales aren't growing, which probably reflects more on the Whole Foods chain than any of it other forays into brick-and-mortar retail. Amazon doesn't break out Whole Foods sales, but the organic grocer had $16 billion in annual sales last year, so it has to be worrisome that sales seem largely flat.

It could become an even more noticeable facet of its operations that the one place Amazon.com isn't seeing sales growth is the one place it has had the greatest impact disrupting and upending: the physical store sales channel.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Rich Duprey has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Amazon. The Motley Fool has a disclosure policy.