In Your 40s? 2 Stocks You Might Want to Buy

If you are in your 40s, you're still building a nest egg... and likely dealing with the responsibilities that come along with a family and home. You aren't yet looking for dividend income, but you can see the day when you might find that attractive. Indeed, you're probably making plans, or at least you should be, to live off of your wealth in retirement some day. Which is why reliable dividend payers ONEOK, Inc. (NYSE: OKE) and A.O. Smith Corp (NYSE: AOS) could both be interesting options for you.

Giving investors two pathways to profit

ONEOK is a large midstream company. It owns the pipes and other assets that help move, process, and store oil and gas. Roughly 90% of its revenues are fee-based, making it a generally stable business. Those fees also provide a great deal of support for its impressive 5.6% yield, which is why reinvesting dividends is the first way for you to build your nest egg here.

Image source: Getty Images

But that's not the only way, because ONEOK has plans to keep expanding, having set the table for growth by recently acquiring its controlled limited partnership. That move will help reduce the cost of capital in the future, and simplifies the pipeline player's business. The goal is to increase the dividend by around 10% a year over the near term. For reference, the company has upped the payment annually for 15 consecutive years. Reinvesting a growing dividend will lead to even faster compounding, which is the second way for you to expand that nest egg.

ONEOK has a track record of success as well, having investing $9 billion in growth projects between 2006 and 2016. It currently has another $3 billion or so in some stage of development, with nearly $500 million worth announced since June of 2017. These four new projects are great examples of ONEOK's growth prospects, as each of them is backed by a committed customer.

A quick snapshot of ONEOK. Image source: ONEOK, Inc.

The only problem here is ONEOK's debt load, which is too high for management's taste right now. The plan is to grow its business and get debt to EBITDA down to around 4 times. It's made great progress toward this level in recent years, moving from 6.7 times in 2013 to an expected 4.7 this year. Watch this metric, of course, but know that material strides have already been made.

If you can handle the leverage issue, this is a good opportunity to pick up a big yield that looks set to grow in the low double digits. If you reinvest that dividend until you retire you could wind up with a hefty income stream to supplement your Social Security down the line.

Low yield, big growth opportunities

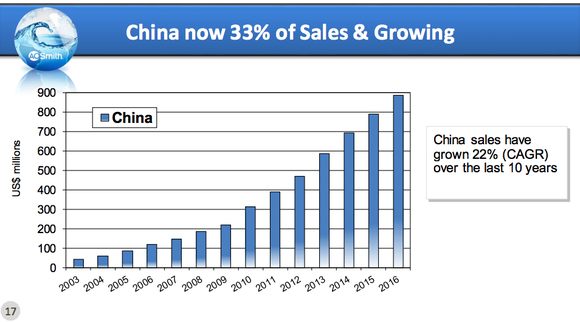

A.O. Smith's big business is water heaters. You'd think it would be a stodgy old industrial company, but that's just not the case. You see, developed nations take hot water for granted. In developing nations it's an affordable luxury that everyone wants if they can get it. That's why Smith has been able to grow sales in China at an incredible 22% annualized rate over the last decade. And it expects more good things from this nation as well, as even more of its citizens climb the socioeconomic ladder.

But here's the really exciting part: Smith is starting to move more aggressively into India, using the same playbook it executed in China. If it can achieve similar growth in India as it did in China, A.O. Smith's growth will be impressive. But just how impressive? The company has grown its top line by 21% a year since the turn of the decade and the bottom line by 26%.

Smith's impressive success in China. Image source: A.O. Smith

Growth will ebb and flow over time, of course. For example, as Motley Fool's Tyler Crowe noted, the most recent quarterly results were good but not great. However, they were strong enough for management to raise guidance. And in addition to the Asian growth story driving slow and steady growth, the company is moving into related businesses, like air and water purification systems.

The dividend yield here is tiny, at just 0.9%, so this isn't an income play -- it's a growth story. But don't count the dividend out: Smith has increased it for 24 consecutive years. The annualized growth rate over the last decade was a huge 15%. If A.O. Smith can continue to execute like it has, you'll get capital appreciation and a swiftly growing dividend, too. In 20 years the income stream could be larger than you think, particularly if you reinvest those payments today.

Looking to the future

If you're in your 40s you have a long time to go before you stop punching the clock. But that doesn't mean an income play like ONEOK can't help you build your nest egg -- just make sure you use those growing dividends to reinvest in the pipeline company. A.O. Smith, meanwhile, has a huge opportunity as it continues to expand in Asia. That should lead to capital appreciation and dividend growth. In 20 years or so, both of these companies could be huge cash flow generators to supplement your Social Security when you finally kick back and retire.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends ONEOK. The Motley Fool has a disclosure policy.