How coronavirus could permanently change our lives, according to Goldman Sachs

As the coronavirus disrupts everyday life, experts are beginning to think about what changes will be temporary and what changes will be permanent.

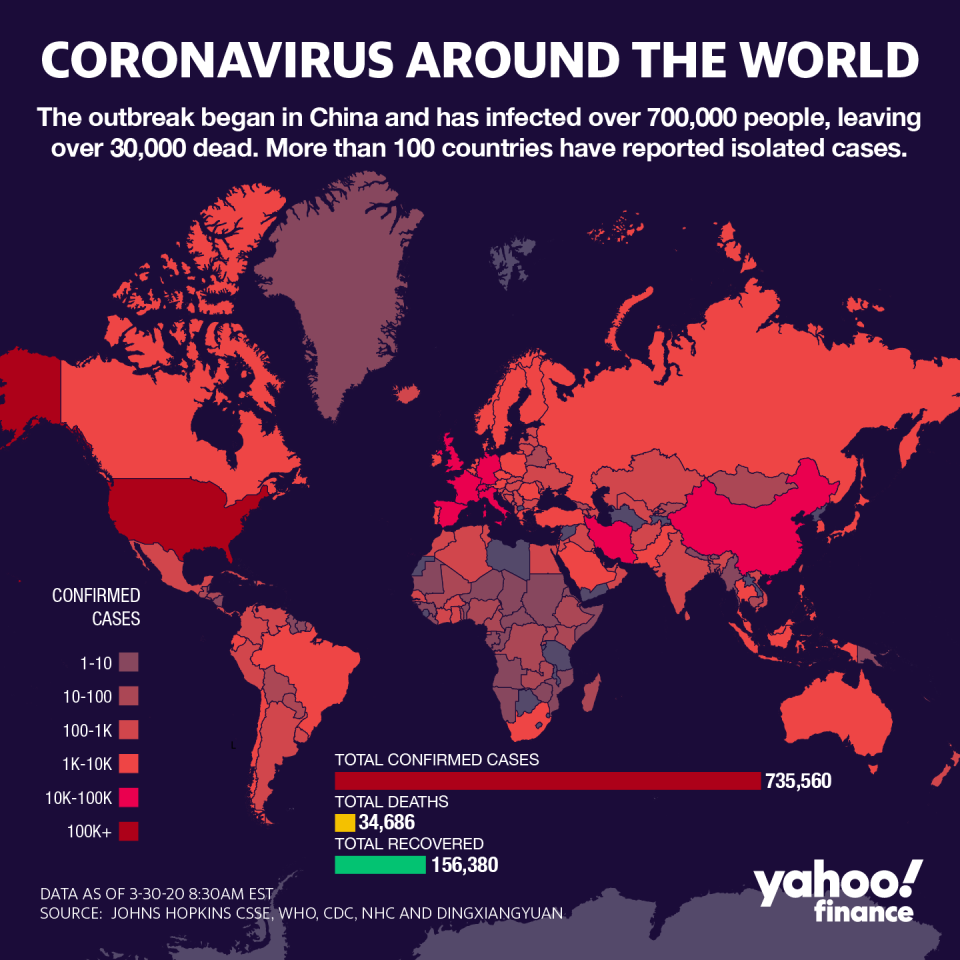

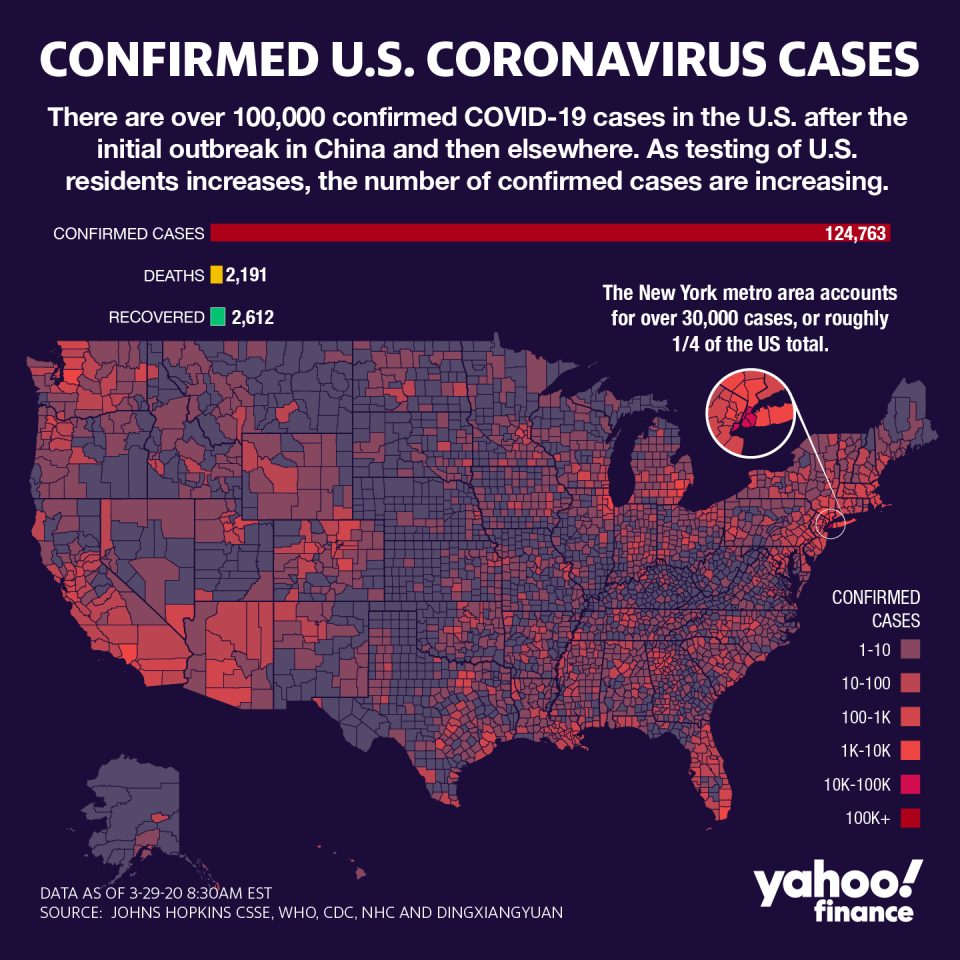

The COVID-19 pandemic has forced hundreds of millions of people around the world to distance themselves from each other, sending massive shockwaves through the global economy that we’re only beginning to understand.

One area that’s become particularly hard hit is the global oil industry, where prices have crashed and have called into question the long-term viability of many of the players. It’s a complicated industry where in some cases the costs of shutting down a well are so high that drillers are paying customers to take oil away.

“The global economy is a complex physical system with physical frictions, and energy sits near the top of that complexity,” Goldman Sachs’ Jeff Currie wrote in a note to clients on Monday. “It is impossible to shut down that much demand without large and persistent ramifications to supply.“

In his note, Currie explores the immense challenges the industry faces as it aims to balance supply and demand in a profitable way.

And Currie’s exploration of the long-term implications of the coronavirus pandemic gives us a glimpse into how the firm is thinking about what the world will look like once this crisis is behind us.

[See Also: A coronavirus scenario everyone wants to avoid]

Climate change debate evolves

“The climate change debate will almost certainly take a different course when the global economy emerges from this and is faced with the prospect of having to make large-scale investments into carbon-based industries,” Currie wrote.

“The silver lining of the coronacrisis is that the virtual shutdown of key carbon industries – autos, airlines and cruise ships – is likely to cause carbon emissions to fall this year, with initial data from China pointing to a c.20%+ fall during the peak of the shutdown,” he added.

We’ve already seen numerous reports of how pollution levels have been tumbling around the world.

The irony of the situation is that low oil prices are forcing massive cuts to supply, which will be slow to return when demand bounces back. And when demand outpaces supply, you get inflation. And suddenly, industries that rely on petroleum will feel the pain of surging costs, and they in turn may be forced to make long term changes.

‘People are adapting’

And it’s not just business economics. The way people live may be changing.

Social distancing and working from home — and all the changes in consumption that comes with it — began as a temporary change. And now it may be becoming routine. And the longer it lasts, the more people may embrace aspects of the lifestyle, permanently.

“People are adapting to a more local existence and living off more sustainable activities, consuming less globally-produced fresh food, producing less waste with a more conservative approach to consumption, all of which may have lasting impacts on demand,” Currie added. “Further, commuters and airlines account for c.16.0 million b/d of global oil demand and may never return to their prior levels.”

When the coronavirus crisis recedes, people will surely want to get back on the road and do things like they used to before the outbreak. But again, the risk is tight energy supplies may quickly translate to higher prices for things.

“While oil prices are low today and physical constraints are forcing the behavioral changes, as oil shortages develop once economic activity normalizes, the high oil prices will likely accelerate the energy transition by constraining demand,” Currie said.

And so these dynamics may prove bullish for sustainable industries.

“Higher oil prices would also greatly improve the relative economics of EVs and hydrogen,” he said. “But from the supply side, capital markets’ push for de-carbonization is likely to prevent the broad investment the industry will need to get out of this crisis and will reinforce a tight physical market beyond 2020.”

In other words, the oil industries woes will be exacerbated by the fact that investors just don’t want to put money into it.

Of course, all of this depends on how long the coronavirus pandemic keeps economic activity frozen.

[See Also: 20 stock investing tips for beginners]

—

Sam Ro is managing editor at Yahoo Finance. Follow him on Twitter: @SamRo

Read more:

'We are all in the dark': Wall Street's smartest are making guesstimates

Why Warren Buffett’s 2008 message to investors was perfectly timed

Why a big market rally right now is no reason to get excited

Something dangerous is happening beneath the surface of the selloff

The incredibly bullish force investors can’t afford to ignore

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.