EUR/USD Mid-Session Technical Analysis for November 20, 2017

The EUR/USD trading lower shortly after the U.S. opening, but the Forex pair has clawed back most of its earlier loss, putting it in a position to turn higher for the session.

The catalyst for the early weakness was a report from Germany which said German Chancellor Angela Merkel’s efforts to form a three-way coalition government failed, stoking political uncertainty in the Euro Zone’s largest economy.

The rebound rally suggests investors believe the issue is local and should not have an impact on any European Central Bank monetary policy decisions.

Daily Technical Analysis

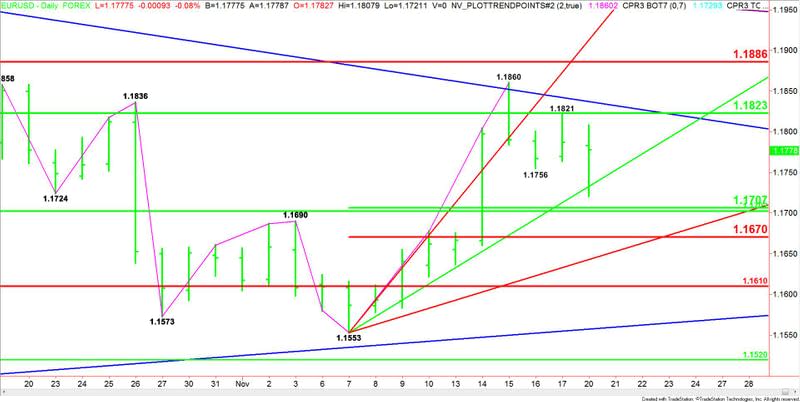

The main trend is up according to the daily swing chart. A trade through 1.1860 will signal a resumption of the uptrend.

The minor trend is down. It turned down on the move through 1.1756. This shifted momentum to the downside. A trade through 1.1821 will turn the main trend back up.

On the upside, the key resistance is a retracement zone at 1.1823 to 1.1886. This zone stopped the rally last week at 1.1860 and 1.1821.

The short-term range is 1.1553 to 1.1860. Its retracement zone at 1.1707 to 1.1670 is the primary downside target. Inside this zone is a major 50% level at 1.1702. Since the main trend is up according to the daily swing chart, we expect buyers to return on a test of this retracement area especially on a test of the support cluster at 1.1707 to 1.1702.

Daily Technical Forecast

Earlier in the session, the EUR/USD found support on the uptrending angle at 1.1733. This move created enough upside momentum to drive the market higher. If the buying continues to strengthen then look for the rally to extend into 1.1823 then a long-term downtrending angle at 1.1837. This angle is a potential trigger point for an acceleration into 1.1860 then 1.1886.

If the selling pressure resumes then we could see a retest of the uptrending angle at 1.1733. If this angle fails then look for the selling to extend into the support cluster at 1.1707 to 1.1702. Look for a technical bounce on a test of this area. If it fails then we could see a further sell-off into 1.1670 then 1.1643.

This article was originally posted on FX Empire