IMF Sees OPEC+ Oil Output Lift From July in Saudi Economic Boost

(Bloomberg) -- The International Monetary Fund expects OPEC and its partners to start increasing oil output gradually from July, a transition that’s set to catapult Saudi Arabia back into the ranks of the world’s fastest-growing economies next year.

Most Read from Bloomberg

TikTok Set to Remove Executive Tasked With Fending Off US Claims

Tesla Spends Weekend Cutting Prices of Cars and FSD Software

US House Passes $95 Billion in Aid to Ukraine, Israel and Taiwan

“We are assuming the full reversal of cuts is happening at the beginning of 2025,” Amine Mati, the lender’s mission chief to the kingdom, said in an interview in Washington, where the IMF and the World Bank are holding their spring meetings.

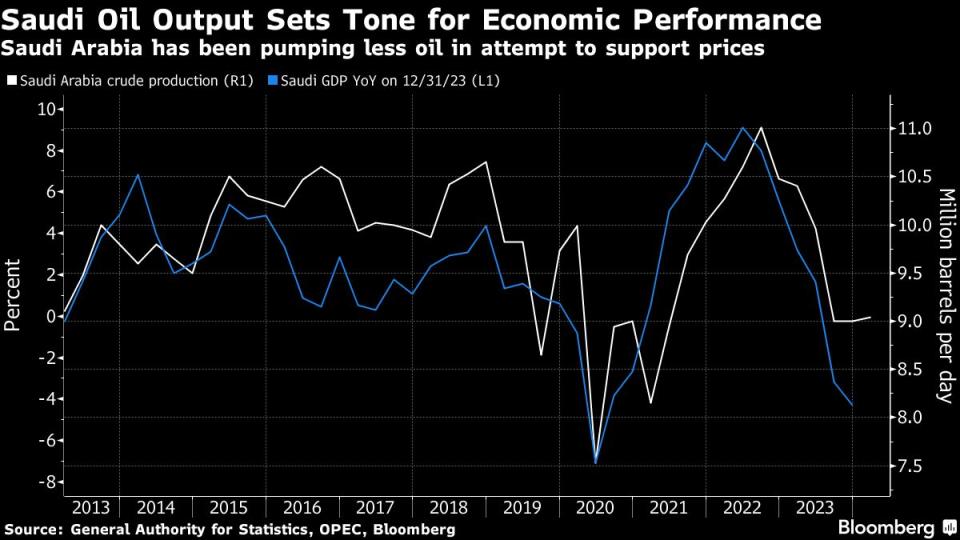

The view explains why the IMF is turning more upbeat on Saudi Arabia, whose economy contracted last year as it led the OPEC+ alliance alongside Russia in production cuts that squeezed supplies and pushed up crude prices. In 2022, record crude output propelled Saudi Arabia to the fastest expansion in the Group of 20.

Under the latest outlook unveiled this week, the IMF improved next year’s growth estimate for the world’s biggest crude exporter from 5.5% to 6% — second only to India among major economies in an upswing that would be among the kingdom’s fastest spurts over the past decade.

The fund projects Saudi oil output will reach 10 million barrels per day in early 2025, from what’s now a near three-year low of 9 million barrels. Saudi Arabia says its production capacity is around 12 million barrels a day and it’s rarely pumped as low as today’s levels in the past decade.

Mati said the IMF slightly lowered its forecast for Saudi economic growth this year to 2.6% from 2.7% based on actual figures for 2023 and the extension of production curbs to June. Bloomberg Economics predicts an expansion of 1.1% in 2024 and assumes the output cuts will stay until the end of this year.

Worsening hostilities in the Middle East provide the backdrop to a possible policy shift after oil prices topped $90 a barrel for the first time in months. The Organization of Petroleum Exporting Countries and its allies will gather on June 1 and some analysts expect the group may start to unwind the curbs.

After sacrificing sales volumes to support the oil market, Saudi Arabia may instead opt to pump more as it faces years of fiscal deficits and with crude prices still below what it needs to balance the budget.

Saudi Arabia is spending hundreds of billions of dollars to diversify an economy that still relies on oil and its close derivatives — petrochemicals and plastics — for more than 90% of its exports.

Restrictive US monetary policy won’t necessarily be a drag on Saudi Arabia, which usually moves in lockstep with the Federal Reserve to protect its currency peg to the dollar.

Mati sees a “negligible” impact from potentially slower interest-rate cuts by the Fed, given the structure of the Saudi banks’ balance sheets and the plentiful liquidity in the kingdom thanks to elevated oil prices.

The IMF also expects the “non-oil sector growth momentum to remain strong” for at least the next couple of years, Mati said, driven by the kingdom’s plans to develop industries from manufacturing to logistics.

The kingdom “has undertaken many transformative reforms and is doing a lot of the right actions in terms of the regulatory environment,” Mati said. “But I think it takes time for some of those reforms to materialize.”

Most Read from Bloomberg Businessweek

What Really Happens When You Trade In an iPhone at the Apple Store

Rents Are the Fed’s ‘Biggest Stumbling Block’ in Taming US Inflation

Aging Copper Mines Are Turning Into Money Pits Despite Demand

©2024 Bloomberg L.P.