Millions of Canadians get their carbon tax rebates today. So why do many not believe it?

About $2.3 billion in federal carbon-tax rebates will be paid out to roughly 12 million Canadians today, even though many of them may not realize it.

The quarterly payments go out to every tax-filing adult household in the eight provinces where the federal carbon tax applies: Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador.

The Canada Revenue Agency says 81 per cent of those folks will get their money via direct deposit, while cheques will be mailed to the other 19 per cent.

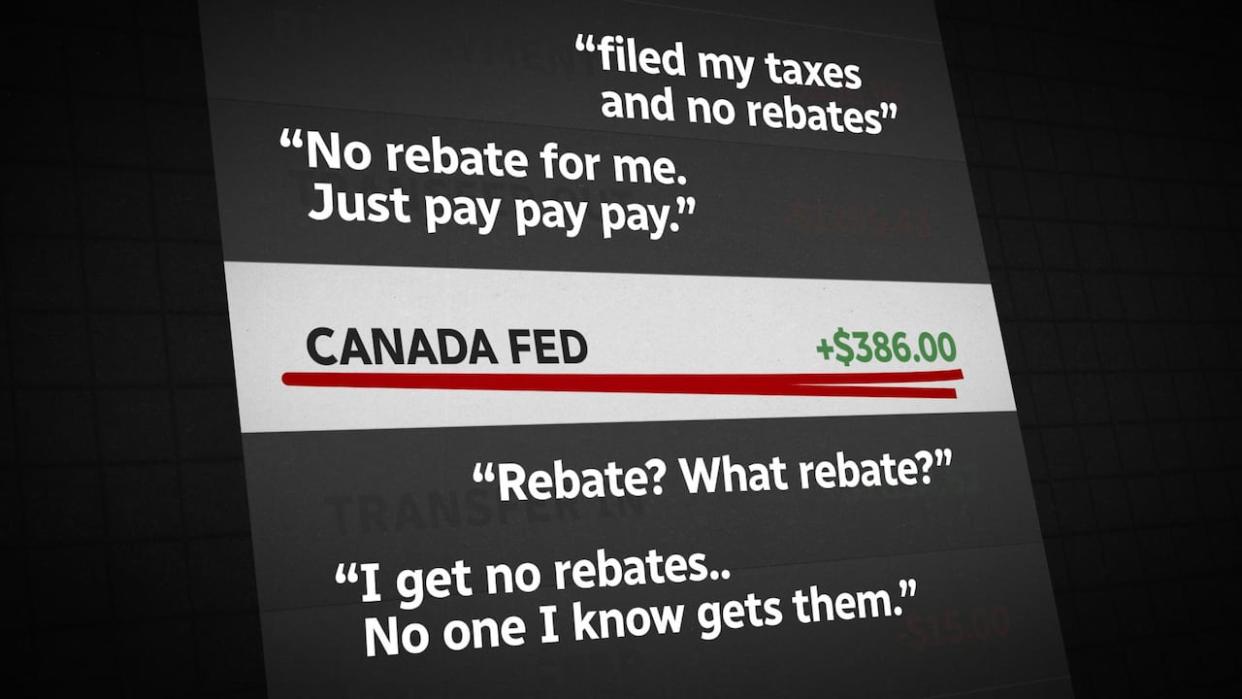

And yet, many Canadians who are eligible for the rebates don't believe they actually receive them, according to recent polling by the Angus Reid Institute. (Not to mention the plethora of online comments whenever the carbon tax is in the news.)

The rebates range in value depending on the size of your household and where you live. A single adult living in P.E.I. gets $120 every three months, while a a family of four living in rural Alberta gets $425.

So why do many people not believe it?

Experts say a few factors are likely at play. Either these folks are actually missing out because they haven't filed their income taxes, or they're simply not noticing the money when it arrives, or they're mistaking it for some other type of payment from the government.

If you're married or have a common-law partner, the rebate goes to only one spouse in the household. So it's also possible some spouses are receiving the funds without the other spouse knowing.

Underpinning all this is "a failure at the most basic level of retail political communication" by the federal Liberal government about one its flagship policies, says Shachi Kurl, president of the Angus Reid Institute.

'What we have here is a failure to communicate'

The ins and outs of carbon pricing policy are complex, but the fact that people are getting a substantial amount of money from the government every three months shouldn't be that hard to get across, in Kurl's view.

She believes the federal Liberals have not done that effectively, choosing rather to focus their communication efforts on the environmental aspects of the policy rather than its financial aspects.

She says that may have been a good strategy in 2019, when Canadians saw climate change as a top priority, but the Liberals have failed to adapt their message to 2024, when the cost of living has become a more pressing concern.

Meanwhile, the federal Conservatives have been relentlessly attacking the federal carbon tax in financial terms.

Partisanship can often affect beliefs, and the Angus Reid polling indeed found that people who said they had voted Conservative in the last federal election were more likely than those who voted Liberal or NDP to believe they are paying more in carbon tax than they are receiving in rebates (even though economists say the opposite is true for most households.)

But when it came to the poll's question about whether people received a rebate at all, there wasn't as much variation between Conservative, Liberal and NDP voters.

Regardless of party support, Kurl said the polling data shows "a massive number of Canadians who either believe that they are not receiving a rebate when they are, or don't know if they're receiving a rebate or not."

"It could be as simple as what we have here is a failure to communicate on part of the federal government in terms of what people are actually receiving," she said.

Part of that may be due to how the funds arrive.

'EFT Deposit from CANADA'

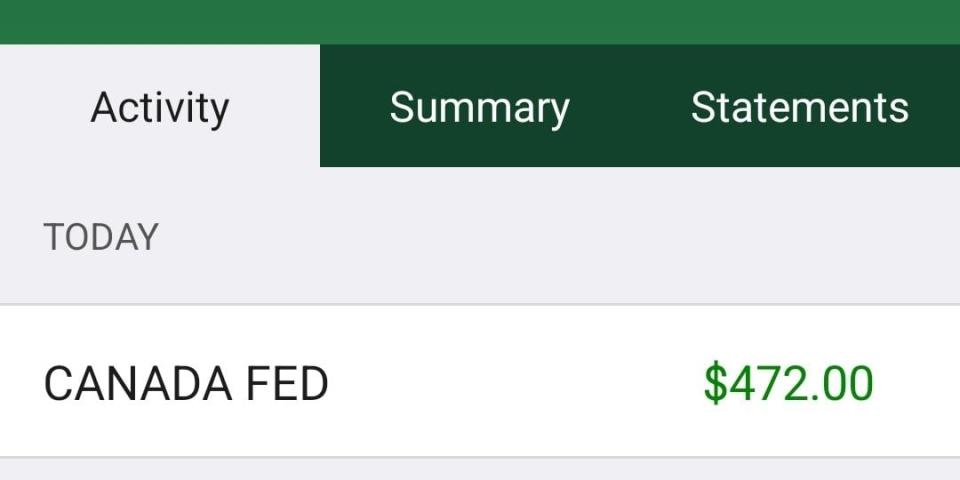

For years now, Canadians have been confused by deposits showing up in their bank accounts under nondescript names like "CANADA FED" or "DN CANADA FED/FED" or "EFT Deposit from CANADA".

Many people didn't realize these were carbon tax rebates. Some even thought they might be some type of scam.

Exactly how the rebates appeared varies from bank to bank.

In 2022, Environment Minister Steven Guilbeault asked Canadian banks to refer to them as climate action incentive payments, which is the official term the federal government uses. Still, variation in the labelling persisted.

A spokesperson with the Canada Revenue Agency said banks are provided with descriptions of transactions from the federal government but the banks "are under no obligation to implement the description text exactly as provided."

An example of an online bank statement showing a carbon-tax rebate direct deposit from 2022. (Screenshot)

Not everyone receives the rebates via direct deposit, either. Some people still get cheques in the mail, and that, too, can be a source of confusion.

"If you changed your address during the year, maybe you didn't receive the cheque," said Yannick Lemay, a senior tax specialist with H&R Block. "Maybe the cheque got lost."

He said it is possible to log in to your Canada Revenue Agency account online to see if you have any uncashed cheques owed to you — or have a tax consultant do that for you.

And for those who actually haven't received a rebate because they've neglected to file their taxes, he says there's some good news — those rebates are still owed to you and you can still claim them when you file your taxes for past years.

"That's money that people leave on the table if they do not file their taxes," Lemay said.

Who's eligible, exactly?

Virtually everybody who lives in the eight provinces where the federal carbon tax applies is eligible for the rebates.

British Columbia and Quebec are excluded because they have their own carbon-pricing systems. The territories also have different systems when it comes to carbon pricing and rebates.

Everywhere else in the country, there are only a few criteria you must meet in order to be eligible:

You must be at least 19 years old.

If you are under 19 but are or were married, or had a common-law partner, or have a child whom you have lived with, you also qualify.

You must be a resident of Canada in the month prior to the payment.

You must be a resident of an applicable province on the first day of the payment month.

Canadian residents don't need to apply for the rebates; they only need to file their incomes taxes for the previous year (even if they have no income to report) in order for the payments to be sent.

Newcomers to Canada must fill out a form to become eligible for the rebates.

"If you have a spouse or common-law partner, only one of you can get the payment for the family," the Canada Revenue Agency notes on its website. "It will be paid to the person who files their tax return first."

The federal rebates are also unaffected by income. This is sometimes another point of confusion, because income does affect the carbon tax rebates in British Columbia's provincial system. (Income was also a factor for rebates under the now-defunct provincial carbon tax that Alberta had from 2017 to 2019.)

Rural residents — defined as anyone who lives outside a census metropolitan area (CMA) — get a 10-per-cent supplement on top of what residents of CMAs receive.

The payments are issued quarterly. The money typically goes out on the 15th of January, April, July and October, unless the 15th falls on a Saturday or Sunday or federal holiday, in which case payments are issued on the last business day prior to the 15th.

You can use the interactive tool below to calculate the monthly value of your rebate, as well as estimate your monthly carbon tax costs.