How Sam Bankman-Fried’s ex-girlfriend helped topple the crypto king

Caroline Ellison and Sam Bankman-Fried were similar in many ways.

Both were the children of academics, both were hailed as math geniuses, and both embraced “effective altruism” – a philosophy that involves making large sums of money to fund philanthropic pursuits that benefit society to the greatest extent possible.

On paper, it seemed like a match made in heaven.

They met on Wall Street in 2015 and became lovers and colleagues – building FTX, a cryptocurrency empire once revered and promoted by the stars.

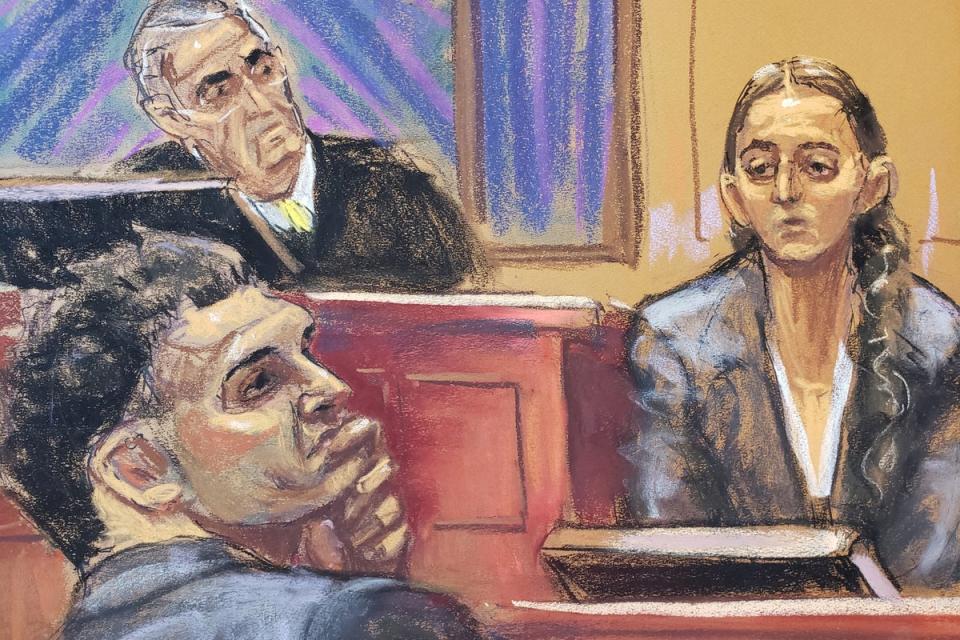

But eight years on, Ellison played a key role in bringing down her former beau as she became the star witness in his multi-billion-dollar fraud trial and sentencing that landed him 25 years in prison.

On Thursday, 28 March, Bankman-Fried was sentenced to 300 months in prison and forced to forfeit $11.2bn based on convictions on two counts of fraud and five counts of conspiracy.

In the high-profile case, jurors heard how the cryptocurrency whiz kid swindled customers’ money from his business FTX and used it to pay off the debts of Alameda Research – a quantitive trading cryptocurrency company he founded in 2017.

He also used the money to fund his lifestyle and desire to become involved in politics, making luxury real estate purchases and hefty political donations.

His dramatic fall from grace comes after Ellison pleaded guilty to seven counts of fraud and conspiracy.

It was a plea deal reached with prosecutors that would grant her a more lenient sentence in exchange for giving damning testimony against her ex-boyfriend.

Bankman-Fried and Ellison first met at Jane Street Capital, a Wall Street trading firm, in the summer of 2015, when he was assigned to teach her class of interns how to trade.

It was here that Ellison said she first became infatuated with Bankman-Fried, who would later become her boyfriend and her boss.

“I was kind of, like, terrified of him,” Ellison testified in court of those early days.

But she was also drawn to what she saw as his ability to use math as a moral guide.

“I was attracted to people thinking about what to do in a quantitative, rigorous way,” she said. “Before that, I don’t think I had much of an impulse to do good in the world.”

But, unlike Bankman-Fried, Ellison claimed to be unsure of herself and second-guessed whether she was having a positive impact on the world through her work on Wall Street.

“I did feel a bit, like, unsatisfied. There was something missing. I wasn’t sure I was doing that much good,” she said of her time at Jane Street Capital.

Three years later, Ellison would be persuaded to quit Jane Street Capital to go and work for Bankman-Fried at his crypto trading firm Alameda Research as his CEO – somewhere where she felt she could put her views on effective altruism into practice.

Bankman-Fried, known by his initials SBF, founded Alameda Research in 2017 after figuring out how to exploit a quirk in crypto values that saw Bitcoin trade for slightly less in Asia than in the US.

But when Ellison arrived at the company, the plan to “do good” somewhat fell apart.

During her time at the company, she said she started to see a darker side to Bankman-Fried’s utilitarianism.

“He said that he was a utilitarian, and he believed that the ways that people tried to justify rules like ‘don’t lie’ and ‘don’t steal’ within utilitarianism didn’t work, and he thought that the only moral rule that mattered was doing whatever would maximize utility, so essentially trying to create the greatest good for the greatest number of people or beings,” Ellison testified at his trial.

She added that Bankman-Fried did not think rules like “don’t lie” or “don’t steal” fit into his utilitarianism framework.

Just two weeks into the job, Ellison called her mother and sobbed into the phone that she’d made the biggest mistake of her life, according to the Wall Street Journal.

Alameda’s dissatisfied partners had persuaded the company’s lenders to demand their money back after they had become disillusioned with Bankman-Fried and the programming software he had developed to trade Bitcoin for more than its worth.

This would be the beginning of what Ellison described as a “constant state of dread” at Alameda’s finances.

In 2019, Bankman-Fried went on to launch the FTX trading platform, promoted to investors as a trusted, straightforward exchange that made money by claiming a percentage of transactions.

When the value of Bitcoin soared in 2021, FTX became one of the largest crypto traders in the world, worth an estimated $32bn.

But FTX’s financial success was not matched by Alameda, whose finances were in a state of chaos, owing to its trading system, Modelbot, created by Bankman-Fried, which was programmed to trade roughly 500 different crypto coins on 30 or so different unregulated crypto exchanges, mostly in Asia.

The system had caused the company to lose millions over the years, meaning it was left with little money to trade with and repay its customers when they called in their loans.

As a result, Ellison said, Bankman-Fried directed her to use FTX customer funds to prop up Alameda.

During the trial, Ellison testified that she committed crimes at the company, including “fraud, conspiracy to commit fraud and money laundering”.

But she insisted that the crimes were committed with Bankman-Fried – and that he had been the mastermind.

Together, the couple defrauded FTX customers and investors, as well as Alameda’s lenders for years.

The decision to use FTX customer funds to cover Alameda’s shortfall, the heart of the alleged fraud, was “Sam’s decision”.

Bankman-Fried repeatedly directed her to repay loans, Ellison testified, explaining: “I understood that he was telling me to use FTX customer funds to repay our loans.”

She also claimed her ex-boyfriend’s utilitarian philosophy made her “more willing to do things like lie and steal over time”.

By contrast, Bankman-Fried insisted that Ellison was responsible for Alameda’s financial woes after she failed to hedge its financial positions early in 2022 to insulate the fund from the market.

The crypto billionaire’s defence also focused on the pair’s on-and-off relationship, which turned romantic in 2018 and caused problems in their working relationship.

“The whole time that we were dating he was also my boss at work, which created some awkward situations,” Ellison testified.

“I would say in our personal relationship there was a general theme that I sort of wanted more from our relationship but often felt like he was distant or not paying attention to me.”

The pair broke up in 2022, with defence attorney Mark Cohen suggesting that Ellison let heartbreak over their breakup impede her business communications in a damaging way.

“I found it difficult to have in-person, one-on-one conversations with him. I tried to avoid those and avoid much time with him in social settings. I continued to have work communications with him over Signal,” Ellison testified.

Meanwhile, both companies continued to lose money as customers recalled billions of dollars in loans and crypto prices collapsed.

“I was concerned that if anyone found out, it would all come crashing down,” Ellison said.

Finally, in November 2022, Ellison’s prediction came true when the crypto trade publication Coindesk published a leaked balance sheet showing that Alameda and FTX were “unusually close” and Alameda’s value was built on a “foundation largely made up of a (digital) coin that a sister company invented”.

The story sent shockwaves through the crypto world, and FTX customers raced to withdraw their funds, exposing an $8bn deficit in FTX’s accounts.

Bankman-Fried’s personal wealth fell by an estimated $16bn in a single day on 8 November. FTX filed for bankruptcy days later and Bankman-Fried resigned as CEO.

He was arrested in the Bahamas on 12 December. Ellison was also arrested.

At first, they both pleaded innocence but questions started to grow around whether the former lovers would turn on each other.

That question was answered when it emerged that Ellison had struck a deal with prosecutors and changed her plea.

She later testified that the ultimate collapse of FTX had brought her an “overwhelming feeling of relief” as it meant she wouldn’t have to “lie anymore”.

Her testimony about her former boyfriend was damning, giving jurors a personal insight into the life behind the crypto empire – and levelling the lion’s share of the blame on Bankman-Fried.

And it appears to have worked as Bankman-Fried sat motionless, looking down at his hands in his lap when the guilty verdict was read out.

Meanwhile, Ellison’s fate is yet to be decided.