Sheinbaum Sees Mexico Deficit Possibly Wider Than Forecast

(Bloomberg) -- Mexico’s deficit in 2025 could reach as much as 3.5% of gross domestic product, the nation’s president-elect said, an indication that she won’t necessarily hold herself to an earlier government forecast of around 3%.

Most Read from Bloomberg

Putin’s Hybrid War Opens a Second Front on NATO’s Eastern Border

Hedge Fund Talent Schools Are Looking for the Perfect Trader

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

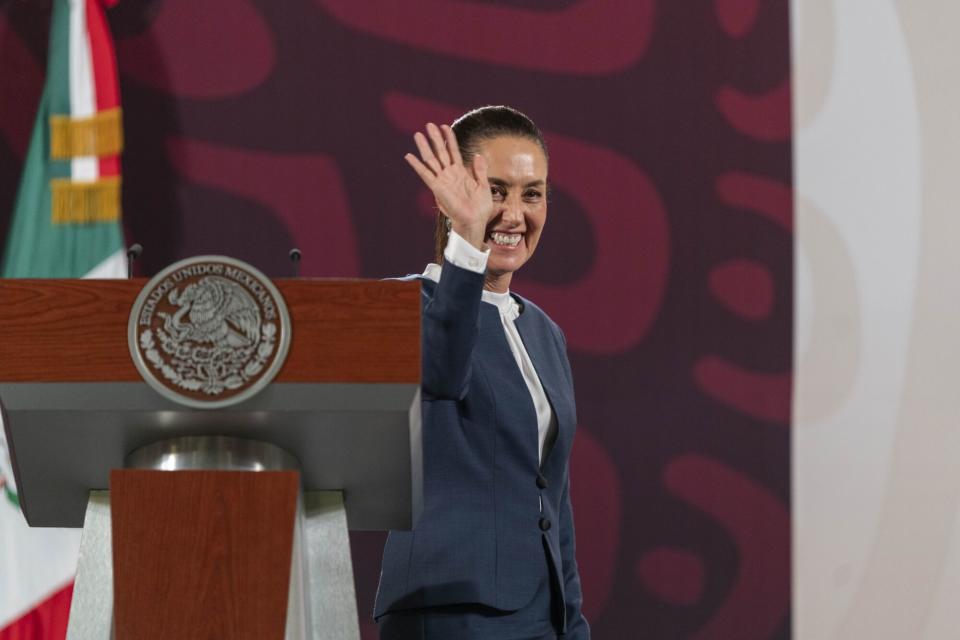

The country will maintain responsible public finances, reduce the deficit and hold off on starting major new works until 2026, Claudia Sheinbaum said Wednesday in a speech before Mexico’s chamber of business executives. She pledged the government would cut operational costs, modernize tax collection, and improve customs as a means of explaining how her administration will prevent this year’s cost increases from carrying into the start of her term.

Although the deficit target is slightly higher than the finance ministry’s earlier goal, it’s better than what most investors have been expecting will be proposed, said Gabriel Casillas, chief Latin America economist at Barclays Plc. Investors are likely to wait to see the budget, which is due in November, before snapping up Mexican assets again and driving up prices, he added.

“The sooner the finance ministry is able to submit the 2025 budget proposal, the better for markets,” Casillas said, estimating the administration could turn in its proposal during the first two weeks of October. A deficit of 3.9% or lower would be seen as a positive sign, he added.

Sheinbaum will be sworn in on Oct. 1, replacing her mentor and fellow Morena party member Andres Manuel Lopez Obrador. Her party’s overwhelming victory in the June 2 election was a surprise to markets, which expected a narrower race. Investors have expressed concerns over whether social programs will lead to overspending, and over Sheinbaum’s ability to push through her initiatives without much resistance from a Morena-dominated Congress.

“We’re going to maintain a responsible equilibrium between debt and GDP, and we’re not going to increase the debt,” said Sheinbaum on Wednesday.

The incoming president sought to assuage investors’ concerns about a judicial overhaul that she has promised will be among the priorities of the new congress when it takes over in September. Rolando Vega, the head of the Mexican Business Council that includes the country’s most prominent leaders, said at the event there were concerns the judicial reform which would have Supreme Court justices elected by popular vote could erode the judiciary’s independence.

“The judicial reform and others that have been proposed are being discussed in an open parliament,” Sheinbaum said. “In no way does this reform represent authoritarianism or a concentration of power. That’s not the goal. The goal is for the judicial authority to have autonomy.”

The new deficit cap proposed by Sheinbaum represents a decline from the estimated deficit levels of 5% of GDP for 2024, which was the highest the government had seen since the late 1980s despite Lopez Obrador’s promises earlier in his term to focus on austerity. The incoming president reiterated that she would not seek to pass major tax reform at the start of her term and said the government will have a plan by December on how to increase Mexico’s potential for development.

Press coverage outside the event on social media showed numerous business luminaries in attendance, including Marco Antonio Slim, a member of the billionaire Slim family and head of its Inbursa bank; Agustin Coppel, chairman of the Coppel banking and retail conglomerate; and Daniel Servitje, chairman of global bread maker Grupo Bimbo. Lopez Obrador worked with some key business leaders on public-private projects over the course of his term despite critiquing Mexico’s elite, and Sheinbaum in the days after her election kicked off a series of meetings that seemed intended on generating investor confidence.

The peso was little changed on the day, trading 0.1% weaker at nearly 18.45 per dollar. The currency has dropped about 8% this month, the worst among major markets.

(Update with analyst comment in third paragraph)

Most Read from Bloomberg Businessweek

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Google DeepMind Shifts From Research Lab to AI Product Factory

©2024 Bloomberg L.P.