The bad economic news that the Fed is looking for

This post was originally published on TKer.com.

Federal Reserve Chair Jerome Powell reiterated the central bank’s top priority right now: Bringing down inflation.

“It’s unconditional, our commitment,” Powell told the House Financial Services Committee on Thursday.

He also acknowledged that the Fed’s efforts could come with some economic pain. When asked about the likelihood of the economy falling into recession as a consequence, Powell told the Senate Banking Committee on Wednesday: “It’s certainly a possibility.”

Earlier this month, the Fed announced a historic interest rate hike after the May consumer price index report suggested the inflation situation was unexpectedly getting worse. The idea is to tighten financial conditions aggressively, which should quickly cool demand in the economy, which in turn should help ease inflation.

It certainly seems to be the case that the economy is slowing. In fact, the economy seems to be doing worse than what economists have been forecasting.

The Citi U.S. Economic Surprise Index, which tracks how actual economic data has performed relative to estimates made by professional economic forecasters, has plummeted to its lowest level May 2020 during the onset of the coronavirus pandemic. Before that, you have to go back to 2011 to see similar lows.

Data released last week suggests that the Fed may be getting the slowing growth that it wants.

The economy is bending, but not breaking … yet

On Tuesday, we learned the Chicago Fed’s National Activity Index1 fell to 0.01 in May from 0.40 in April. A reading of zero reflects trend growth in the economy. And so the report suggests that economic activity has gone from hot to about average.

The S&P Global Flash US Composite PMI report released Thursday echoed this pattern. The headline index fell to a five-month low of 51.2 in June. A reading above 50 reflects growth. And so the report suggests economic activity is decelerating but hasn’t yet gone into contraction.

The reports confirm mounting data that economic growth has been slowing.

But while both reports reflect growth, the direction of the numbers aren’t great for those hoping the economy will avoid recession.

“The pace of US economic growth has slowed sharply in June, with deteriorating forward-looking indicators setting the scene for an economic contraction in the third quarter,” Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said on Thursday.

This challenges the Fed’s intention to address inflation without sending the economy into an outright recession.

The 'too hot' jobs market has gotten a little more 'just right'

There have been nearly two job openings per unemployed person, which has forced businesses in need of workers to raise wages aggressively to secure talent.

Powell believes that by tightening monetary policy, the cooling demand will cause the number of job openings to come down without necessarily causing unemployment to spike, which should help inflationary wage growth cool.

According to jobs site Indeed, job openings have been trending lower in recent weeks. As of June 17, the number of job openings were 54.0% above pre-pandemic levels, down from 54.6% the week prior.

And despite all of this evidence of a cooling economy, unemployment hasn’t moved significantly higher.

Initial claims for unemployment insurance declined to 229,000 for the week ending June 18 from 231,000 the week prior. While the number is up from its six-decade low of 166,000 in March, it remains near levels seen during periods of economic expansion.

Unemployment data bears watching as rising joblessness is one of the primary manifestations of recessions.

The housing market is definitely cooling

One of the clearest signs of tightening financial conditions is rising interest rates. It’s definitely showing up in mortgage rates.

According to Freddie Mac data, the average rate for the 30-year fixed rate mortgage climbed to 5.81% from 5.78% the week prior. It’s now at the highest level since November 2008.

And rising rates are affecting the housing market.

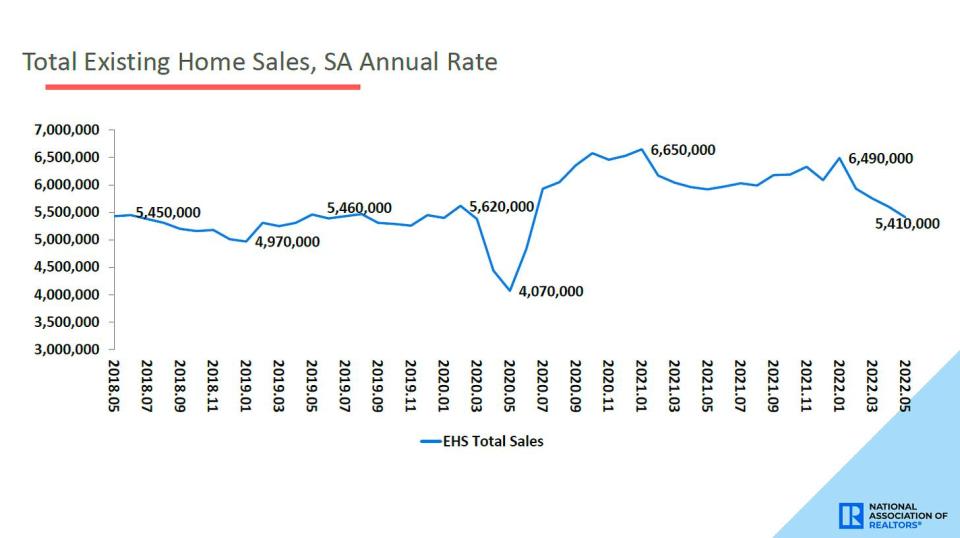

On Tuesday we learned that sales of previously-owned homes fell 3.4% in May to an annualized rate of 5.4 million units, according to the National Association of Realtors (NAR).

“Home sales have essentially returned to the levels seen in 2019 — prior to the pandemic — after two years of gangbuster performance,” NAR chief economist Lawrence Yun said Tuesday. “Further sales declines should be expected in the upcoming months given housing affordability challenges from the sharp rise in mortgage rates this year.“

Sales of newly built homes rose 10.7% in May to an annualized rate of 696,000 units, according to Census Bureau data. However, the trend in recent months continue to be downward.

And there may be signs home prices may cool soon. Here’s Redfin on the four weeks ending June 19: “On average, 6.1% of homes for sale each week had a price drop, a record high as far back as the data goes, through the beginning of 2015.“

Maybe inflation isn’t as bad as we thought

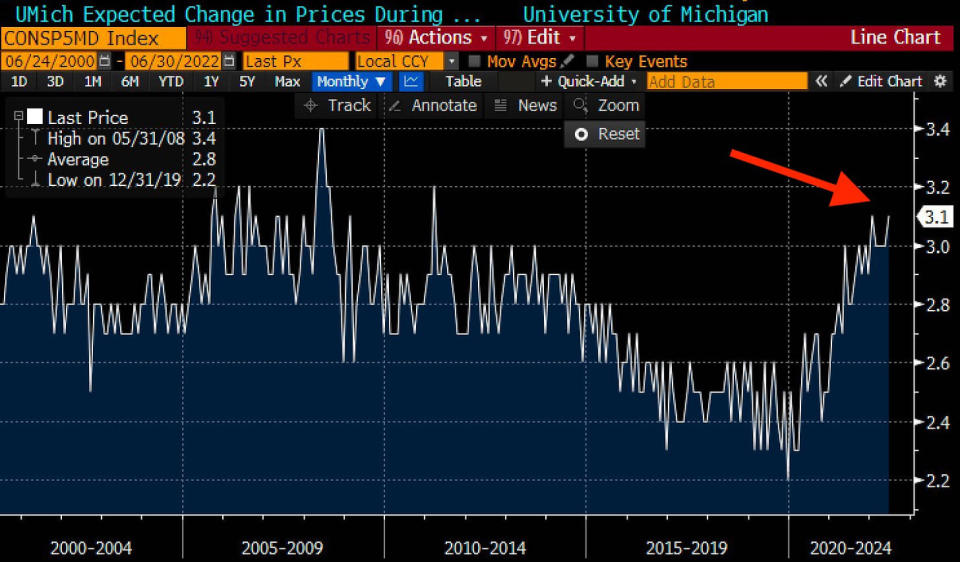

According to the preliminary June results of the University of Michigan consumer sentiment survey released on June 10, consumers’ expectation for inflation five years from now jumped to 3.3% from 3.0% in May. This report was among the reasons why the Fed felt the need to get more aggressive with monetary policy this month.

However, the final results of the survey published on Friday revised that number down to 3.1%. While it’s still elevated, it’s far less alarming than previously thought.

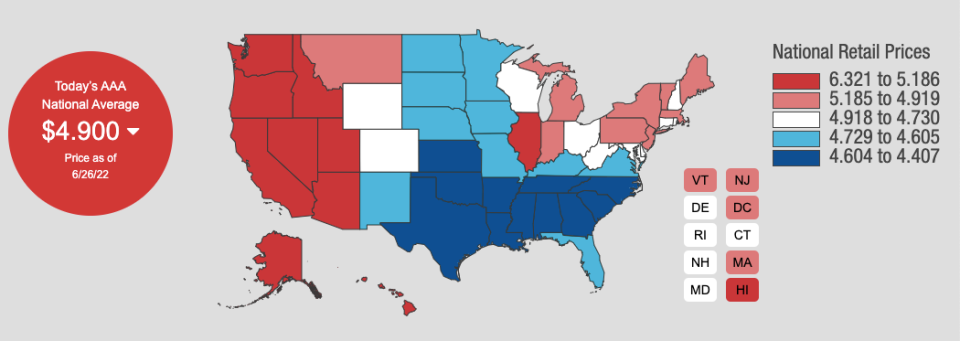

Also, those paying close attention to gasoline prices may have noticed they have come down a little.

According to AAA, the average price of a gallon of regular unleaded gasoline was $4.900 a gallon on Sunday, down from $4.983 a week ago and its record high $5.016 on June 14.

The news comes as oil prices have trended lower over the past three months.

Analysts have blamed the recent decline in oil prices on intensifying recession worries. This dynamic would be in line with the Fed’s plans.

The big picture

Because there seems to be nothing more important than getting inflation under control, bad economic news will be considered good news in that it should mean less pressure on prices.

And so in some twisted way, last week’s gloomy economic news may explain why the stock market rallied a bit last week.

For now, we’re still a long way from having accumulated the “clear and convincing” evidence of moderating inflation that the Fed is seeking out. And so investors should continue to manage expectations as the Fed continues to fight inflation by pressuring the financial markets.

Related from TKer:

The market beatings will continue until inflation improves 🥊

The 'too hot' jobs market has gotten a little more 'just right' 🍲

SPECIAL EDITION: The complicated mess of the markets and economy, explained 🧩

Recap 📋: For a little over a year, the rapid economic recovery came with demand growth sharply outpace supply, causing inflation rates to rise. However, supply has failed to catch up, which is why the Federal Reserve has been tightening monetary policy in its effort to bring down inflation by cooling demand. While economic growth has indeed been slowing in recent months, high inflation persists. And now we have an even more hawkish Fed putting even more pressure on the economy, and it’s doing so by targeting the financial markets.

Last week 🪞

📈 Stocks rally: The S&P 500 climbed 6.4% last week to close at 3,911.74. The index is now down 18.4% from its January 3 closing high of 4,796.56 and up 6.7% from its June 16 closing low of 3,666.77. For more on market volatility, read this and this. If you wanna read up on bear markets, read this.

As I wrote earlier this month, it appears that the markets will be held hostage by the Fed as long as inflation isn’t showing “clear and convincing” signs of easing. Read more about this here and here.

Next week 🛣

It’s busy week for economic data. With inflation top of mind, all eyes will be on Thursday’s release of the core PCE price index, the Fed’s preferred gauge of inflation. Economists estimate the metric increased by 0.3% in May from the month prior, reflecting a 4.6% jump from the prior year. The report will include personal income and spending data for the month.

We’ll also get the May durable goods report on Monday, the Conference Board’s June consumer confidence report on Tuesday, and the June ISM manufacturing report on Friday. All of these stats will help us better understand just how much the economy is cooling.

Below is a schedule of companies announcing quarterly financial results next week, courtesy of The Transcript.

¹ From the Chicago Fed: “The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories… A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.“

This post was originally published on TKer.com.

Sam Ro is the founder of Tk.co. Follow him on Twitter at @SamRo

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube