UK Boosts Borrowing to Cover Deficit, Curbing Tax Cut Hopes

(Bloomberg) -- The UK boosted its borrowing plans after the government’s budget shortfall overshot forecasts, highlighting the constraints Chancellor Jeremy Hunt faces as he eyes pre-election tax cuts.

Most Read from Bloomberg

Biden’s New Chopper Is Demoted After Scorching White House Lawn

Tech Giants Roar as Tesla Spikes in Late Hours: Markets Wrap

Billionaire Pinaults Fight to Pull Gucci Off the Discount Rack

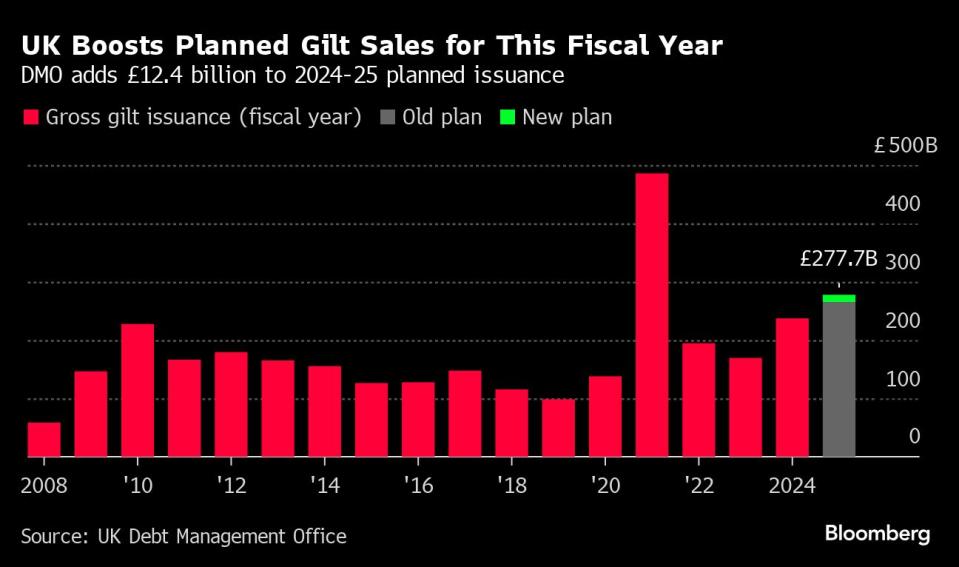

The country’s Debt Management Office said it plans sell £12.4 billion more bonds than originally slated over the fiscal year, adding to what was already the second-largest package on record, and topping the upper end of analyst estimates.

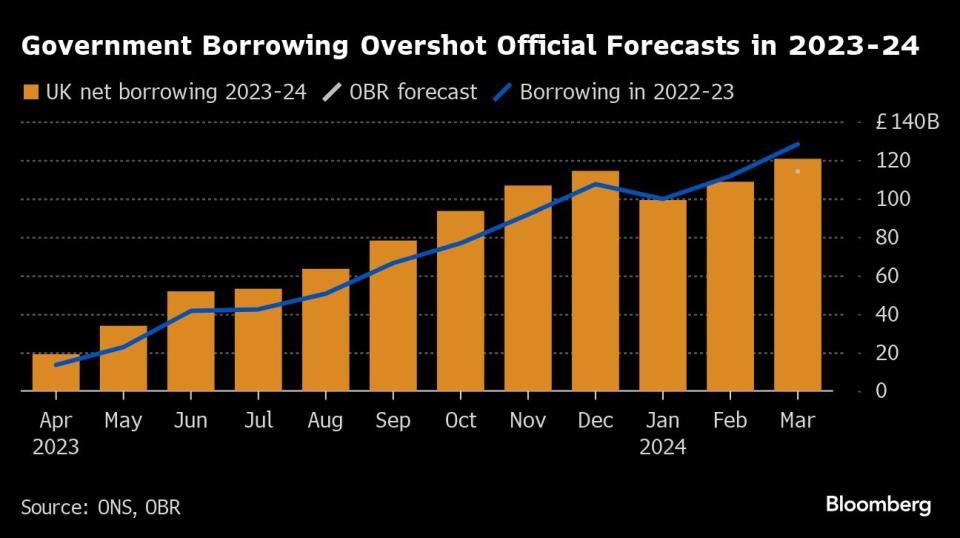

Data earlier showed the budget deficit — while narrowing to £120.7 billion ($149 billion) in the 12 months through March — remained wider than £114.1 billion forecast by the Office for Budget Responsibility just last month.

The figures underscore the pressure on public finances as Prime Minister Rishi Sunak prepares for a general election later this year, possibly as early as October. For investors, it’s the latest reminder of the stark fiscal challenges the country faces. National debt hit £2.69 trillion, or 98.3% of GDP — levels last seen in the early 1960s.

The worse-than-expected data are “casting further doubt on the ability of the government to unveil big tax cuts at another pre-election fiscal event later this year,” said Ruth Gregory at Capital Economics.

“If the Chancellor was hoping March’s figures would provide more scope for tax cuts at a fiscal event later this year, he will have been disappointed.”

Borrowing for the full year was £6.6 billion higher than the Office for Budget Responsibility forecast in March. It said the shortfall was largely because receipts from income tax and national insurance contributions came in £4.5 billion lower than expected.

“This is likely to primarily reflect weaker-than-expected bonuses, particularly from the financial sector,” the OBR said. “Around half of bonuses in the December-to-March bonus season are paid out in March with the tax largely received in April, so this initial estimate could be revised in next month’s release.”

The shortfall in March alone was £11.9 billion, the Office for National Statistics said Tuesday. Economists had expected a deficit of £10 billion.

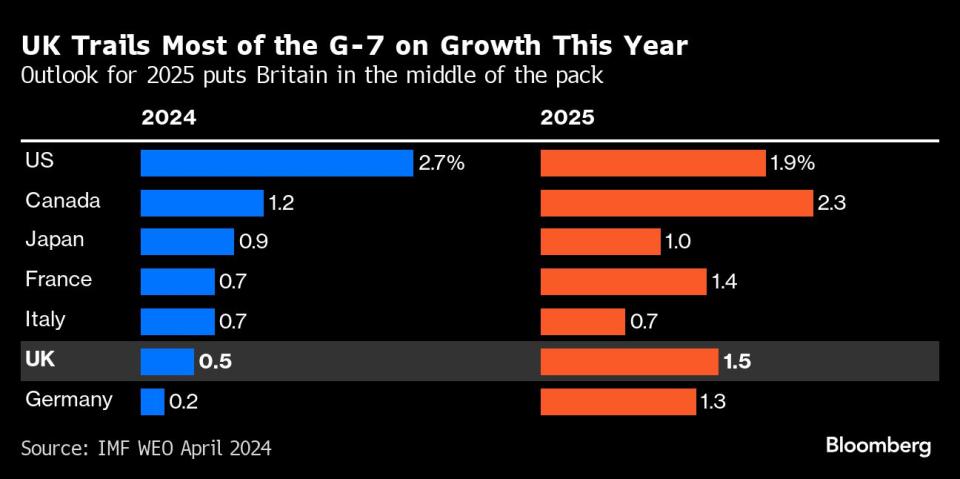

With opinion polls pointing to a landslide defeat for the ruling Conservatives, Sunak and Hunt have made no secret of their desire to cut taxes once more before Britain goes to the polls. However, a £10 billion giveaway last month has left them with little fiscal headroom and the outlook remains hampered by what economists say are weak growth prospects.

That’s a problem too for the opposition Labour Party, which is also promising to cut debt as a share of the economy within five years if it comes to power.

Debt Breakdown

The bulk of the additional bond issuance this fiscal year will come from short-dated bonds, the DMO said, with planned sales increasing by £5.4 billion to account for 36.3% of the total £277.7 billion. Expected sales of medium-dated gilts rose by £3.9 billion.

The funding package carries extra importance for the market given sales from the central bank are also in full swing. If the Bank of England maintains its yearly target of reducing its gilt stockpile by £100 billion, the total stock of debt the market will have to digest this year could reach an all-time high.

Still, the reaction was relatively muted to the prospect of additional supply. UK bonds fell, underperforming European peers. The 10-year yield rose three basis points to 4.23%.

“This is a drop in the ocean,” said Craig Inches, head of rates and cash at Royal London Asset Management. “Seems markets have become fairly immune to debt sustainability concerns, possibly as demand to auctions and supply events have been very robust.”

Competing forces affected the public finances in 2023-24, which saw the deficit fall to its lowest in four years.

“Spending was up about £58 billion, with increased spending on public services and benefits outstripping large reductions in interest payable and energy support scheme costs. But with public sector income up £66 billion, overall, the deficit still fell,” said ONS deputy director for public sector finances Jessica Barnaby.

Debt interest fell 27% to £78.3 billion — the result of a decline in the RPI gauge of inflation against which a quarter of the government debt is priced. But there was a 14.5% increase in welfare to £291 billion and 12.1% rise in staff costs to £195 billion as strikes paid off for public sector workers. The deficit in 11 months through February was also revised up by £1.9 billion.

Offsetting that was a strong rise in government revenue, albeit short of OBR forecasts, as inflation and a resilient labor market boosted income and corporation tax receipts.

Taxes on income and wealth were up 11.5%, or £41 billion, to £395 billion. Corporation taxes jumped above £100 billion for the first time, to £103 billion, after the headline rate was increased to 25% from 19%.

Hunt reiterated his determination to get the debt under control, blaming the poor figures on spending that flowed from the pandemic and to contain a cost-of-living crisis sparked by Russian President Vladimir Putin’s invasion of Ukraine.

“Debt increased in recent years because we rightly protected millions of jobs during Covid and paid half of people’s energy bills after Putin’s invasion of Ukraine sent bills skyrocketing,” Hunt said in a statement. “We can’t leave future generations to pick up the tab.”

--With assistance from Aline Oyamada and James Hirai.

(Adds comment from Office for Budget Responsibility below first chart)

Most Read from Bloomberg Businessweek

A Hedge Fund Billionaire’s Cash Helped Fund a ‘Predatory’ Lender

Big Junk Food’s Campaign to Get You Eating Doritos and Oreos for Dinner

How a Massive Hack of Psychotherapy Records Revealed a Nation’s Secrets

©2024 Bloomberg L.P.